The 1031 Exchange is one topic most people do not talk about because of its complexity. So, let’s try to find out more about it and discuss what it’s all about.

What is 1031 Exchange?

1031 Exchange came from Section 1031 of the US Internal Revenue Services tax code. “It provides an exception and allows you to postpone paying tax on the gain if you reinvest the proceeds in similar property as part of a qualifying like-kind exchange. Gain deferred in a like-kind exchange under IRC Section 1031 is tax-deferred, but it is not tax-free.”

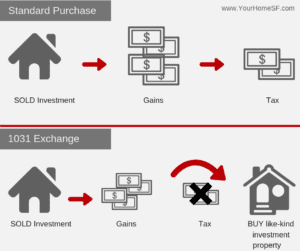

Suppose you have an investment or rental property and you decide to sell it. Normally, you would be needing to pay taxes on the capital gains from that property.

With the 1031 Exchange, you can defer paying taxes by replacing it with one or more like-kind property.

Can I sell my home and apply for a 1031?

If it is a primary residence, if you live in it or it’s your only property, then the answer is NO.

If it is an investment or a rental property aside from your primary home then YES.

What does like-kind property mean?

A like-kind property is a property that is similar in nature with the one being sold – a vacant land to another vacant land, an apartment rental to a commercial office building, a commercial space to two rental properties. The properties should be within the United States.

Can I swap an investment property to any like-kind property and get a full deferral?

Yes, if and only if it has an equal or greater value.

You may still swap it with a property of lesser value. The difference on the value is called boot on which you will need to pay capital gains taxes on. Therefore, you don’t get 100% tax deferral.

Note that other requirements must also be met.

Can I sell my property now, buy a replacement property later and still do a 1031?

Yes, however, there are several structures and timing rules that you must observe.

The most common is a Forward or Delayed, where you sell your property first and then assign your like-kind replacement properties within 45 days. You will then have an additional 135 days to close. That’s a total of 180 days from the time you relinquished your property.

You will need to pay the capital gains tax and other applicable taxes if you fail to meet the deadlines.

Can I just keep the money until I find an appropriate replacement property?

Definitely, not. You void the 1031 Exchange privilege when you do that. Simply put, if you receive cash then you pay tax.

You need to assign a qualified intermediary to make a qualified exchange accommodation arrangement. The qualified intermediary is similar to an escrow company that will facilitate the transfer of your property to the buyer and the replacement property to you.

Why is this relevant?

1031 is a tax efficient manner where investors can use the proceeds from the sale of one property to another. The money you save on taxes will allow you more buying power for the replacement property.

These are just the basic questions about 1031 Exchange. There are a lot of investors who are still intimidated by it because executing it can be tricky. It is advisable to seek professional help to achieve maximum results.

If you want a recommendation for a qualified intermediary or you want to speak with me about this topic, please fill out the form below and indicate the best time for me to call you back.

[contact-form][contact-field label=’Name’ type=’name’ required=’1’/][contact-field label=’Email’ type=’email’ required=’1’/][contact-field label=’Phone’ type=’name’/][contact-field label=’Comment’ type=’textarea’ required=’1’/][/contact-form]