San Francisco Real Estate Market Report – September 2021

Major Market Factors since Spring 2020

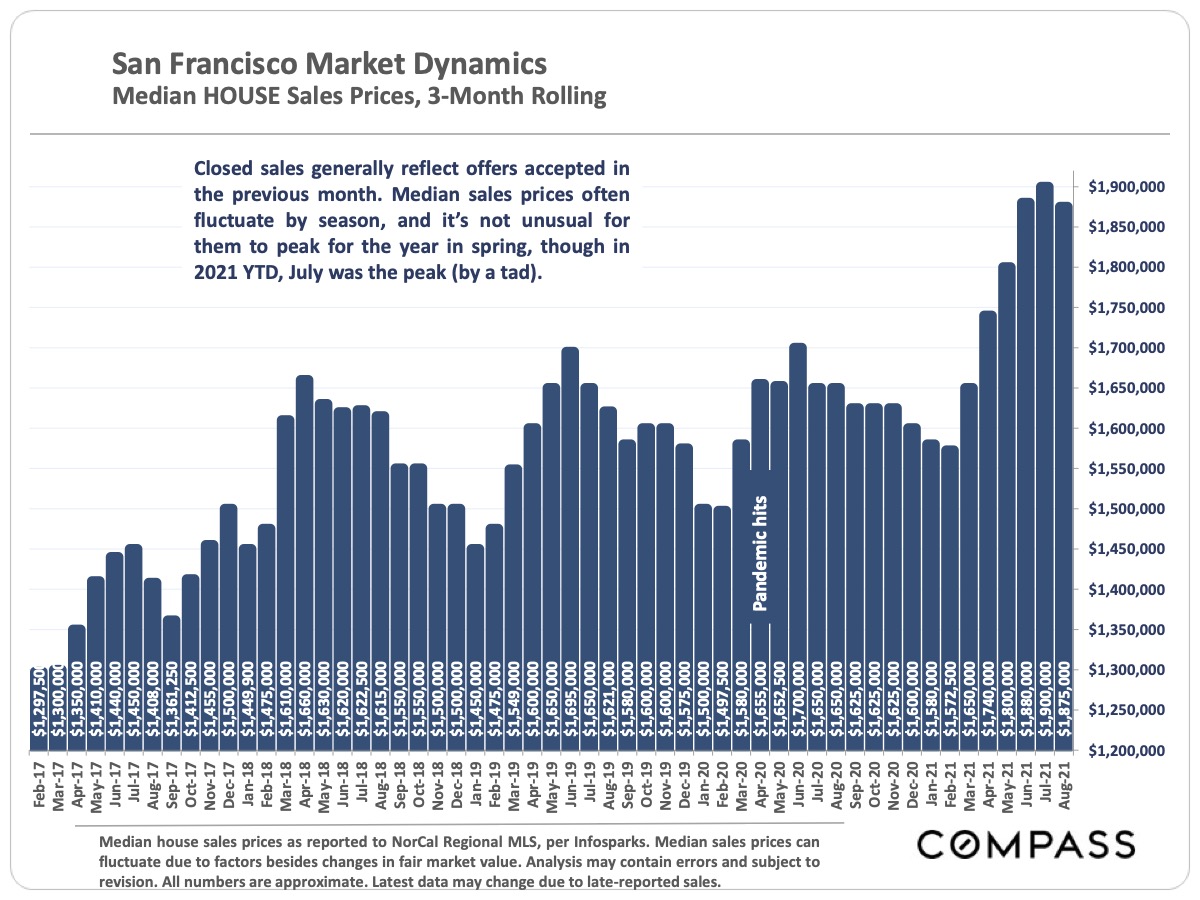

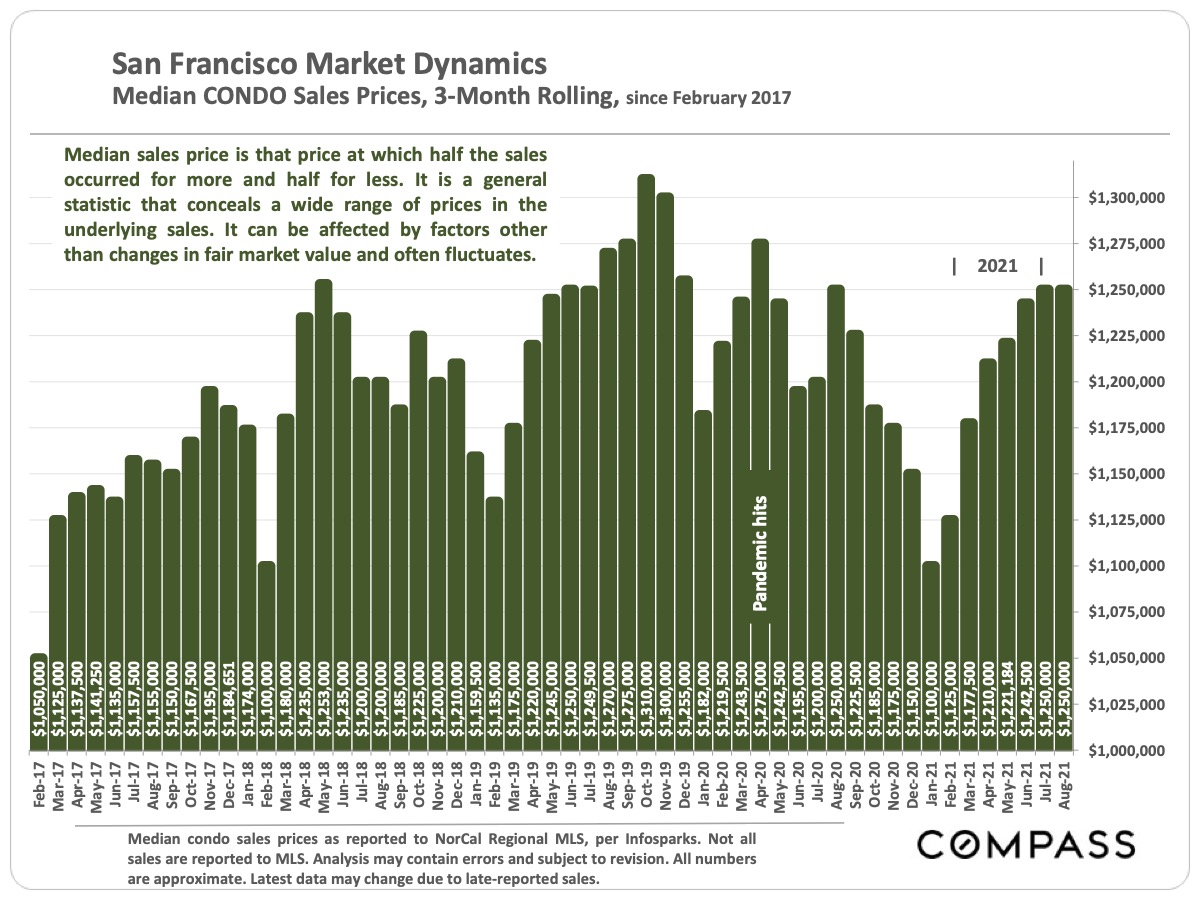

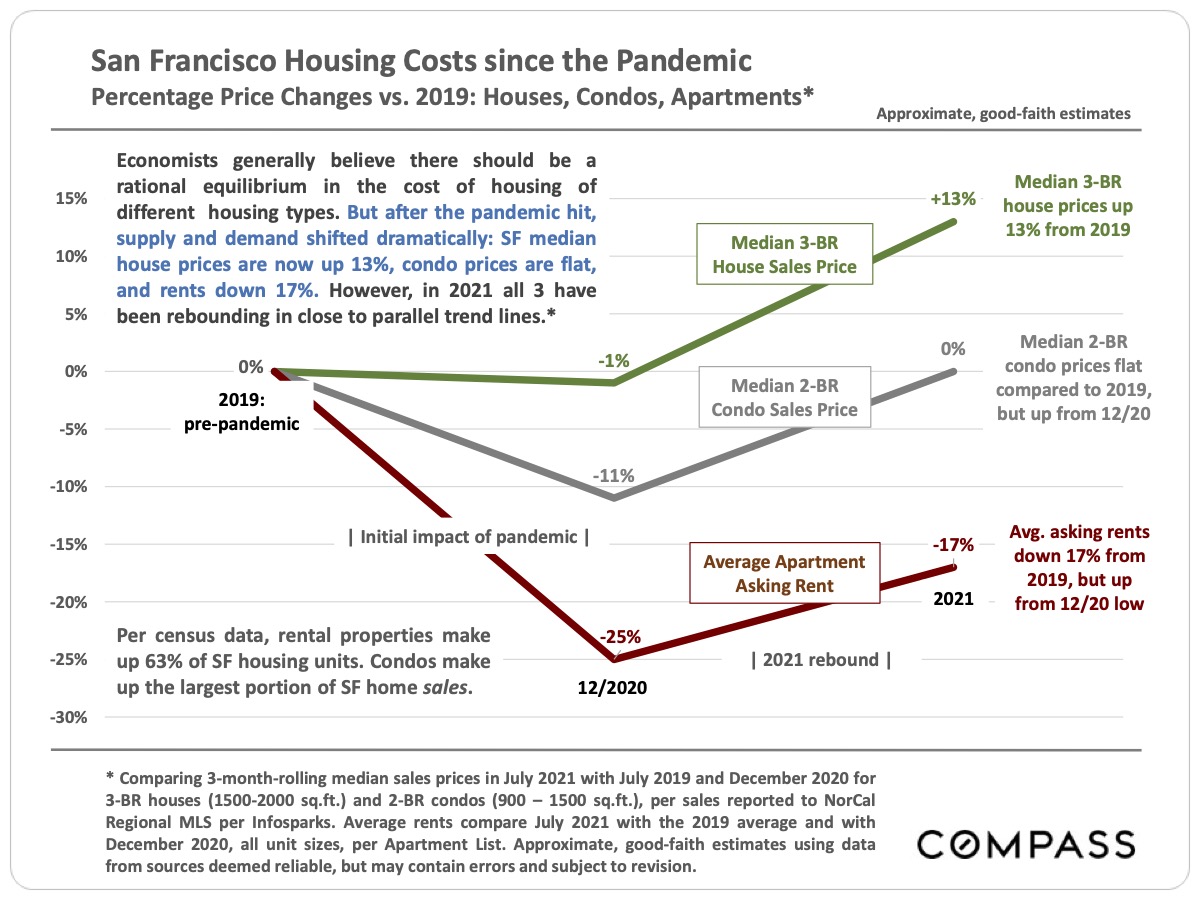

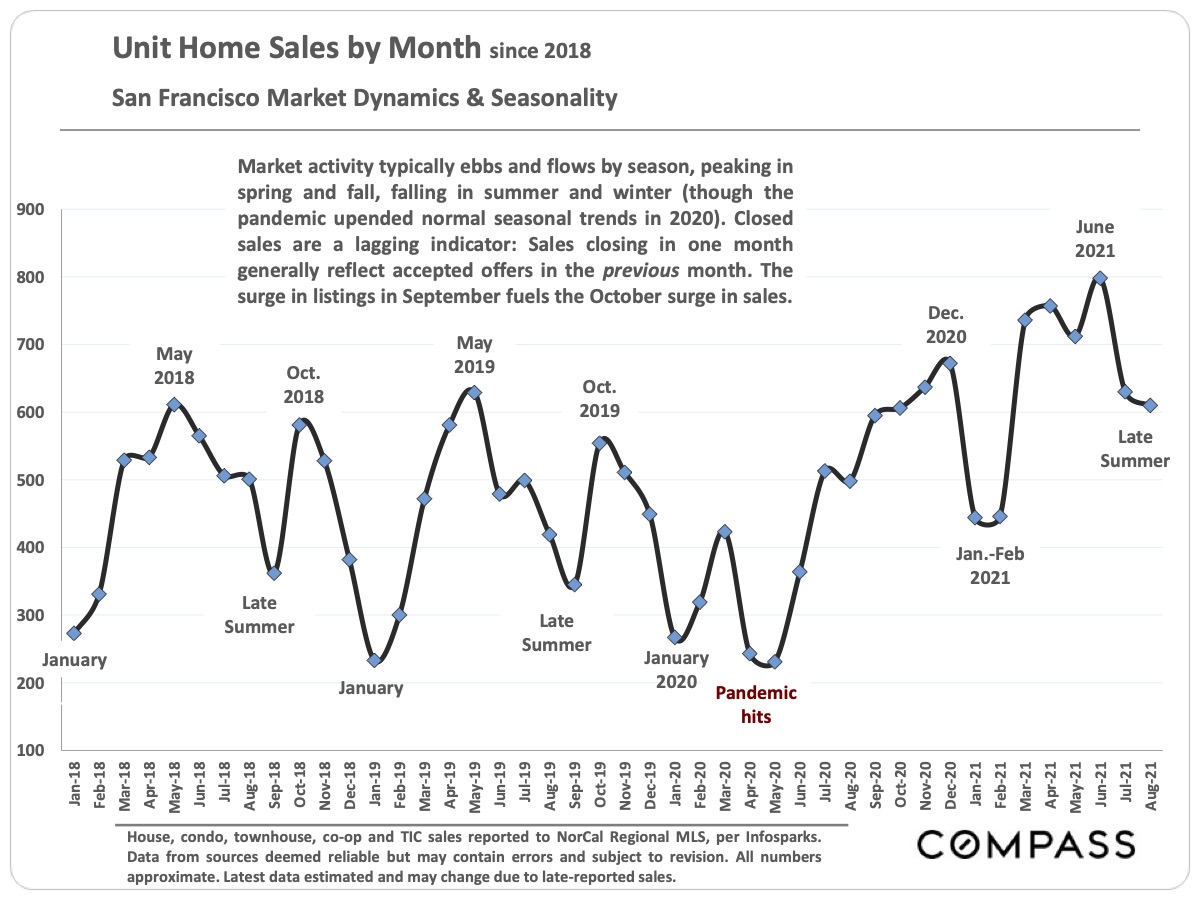

Abnormally high household movement occurred due to pandemic-related, population-density reasons, housing and living costs, family and quality of life issues, and new wealth – moves greatly enabled by work-from-home. There was a considerable increase in the number of buyers for first homes, larger homes and luxury homes. Since Covid and its population density issues, house prices are well up, condo prices are flat (after initially plunging after the pandemic hit), and rents well down. (Rental units make up the majority of SF housing.)

New wealth: Federal and state governments shoveled trillions of dollars to businesses and households, many of which were in no financial distress. Financial markets soared, dramatically increasing the personal wealth of middle class and more affluent households. And house values climbed. These factors contributed to the sense of being wealthier than ever, which helped supercharge the housing market update. The households which did suffer financial hardship were generally less affluent, and more likely to be tenants than homeowners or homebuyers: Their misfortunes and the work-from-home policies of high-tech companies deeply impacted the SF rental market, though it too began to recover since the rollout of vaccines.

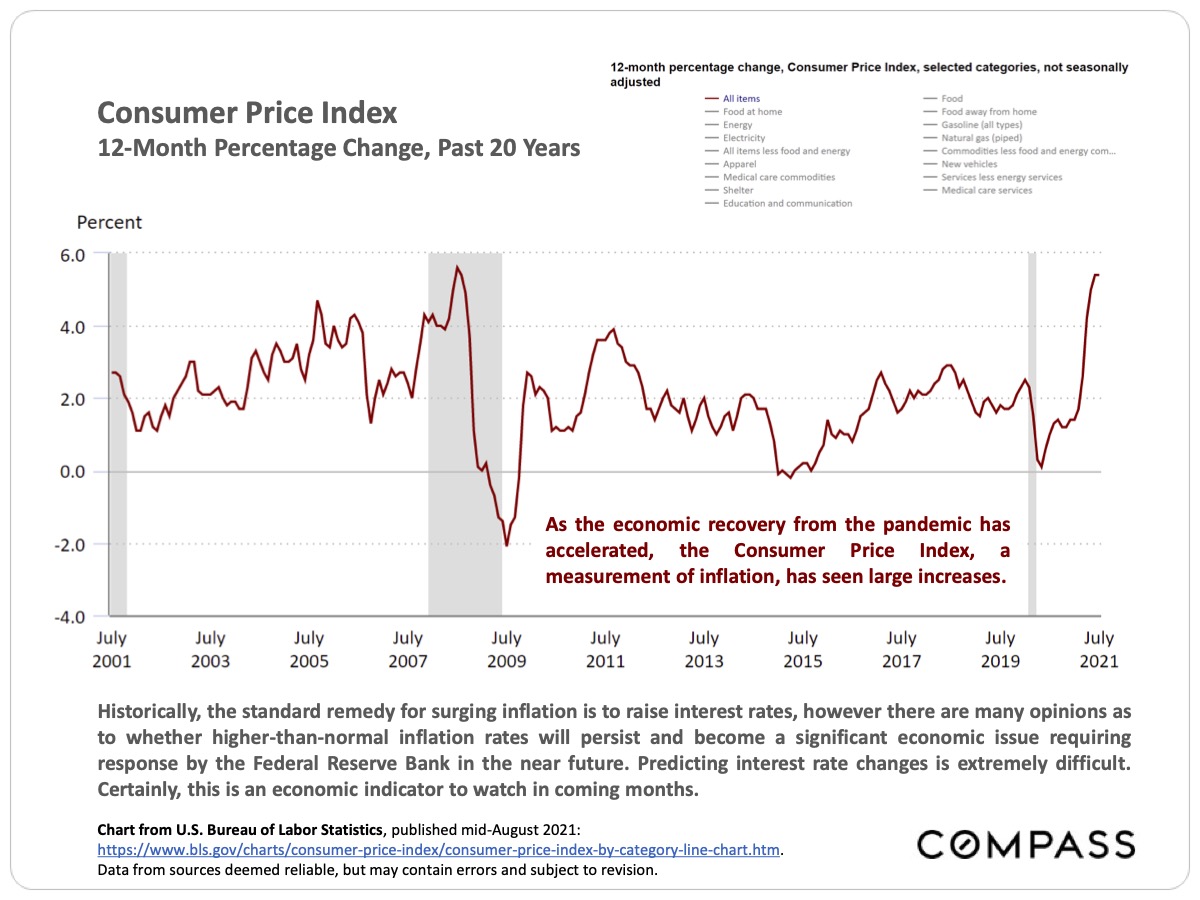

Interest rates: The Fed implemented policies that brought mortgage interest rates down to historic lows, significantly lowering housing costs, and motivating prospective homebuyers to buy sooner than later. (The risk is that if interest rates jump, perhaps due to inflationary pressures – and we are not saying they will – it could have pronounced cooling effect on the market, as it did in mid-late 2018.)

Optimism boosts housing and financial markets: Markets typically move in cycles characterized by pervasive economic optimism, uncertainty or pessimism, and today, optimism generally prevails among those with financial resources. Because there are so many economic, political and ecological factors at play at any given time, it is extremely difficult to predict the timing, duration or magnitude of market cycles up or down.

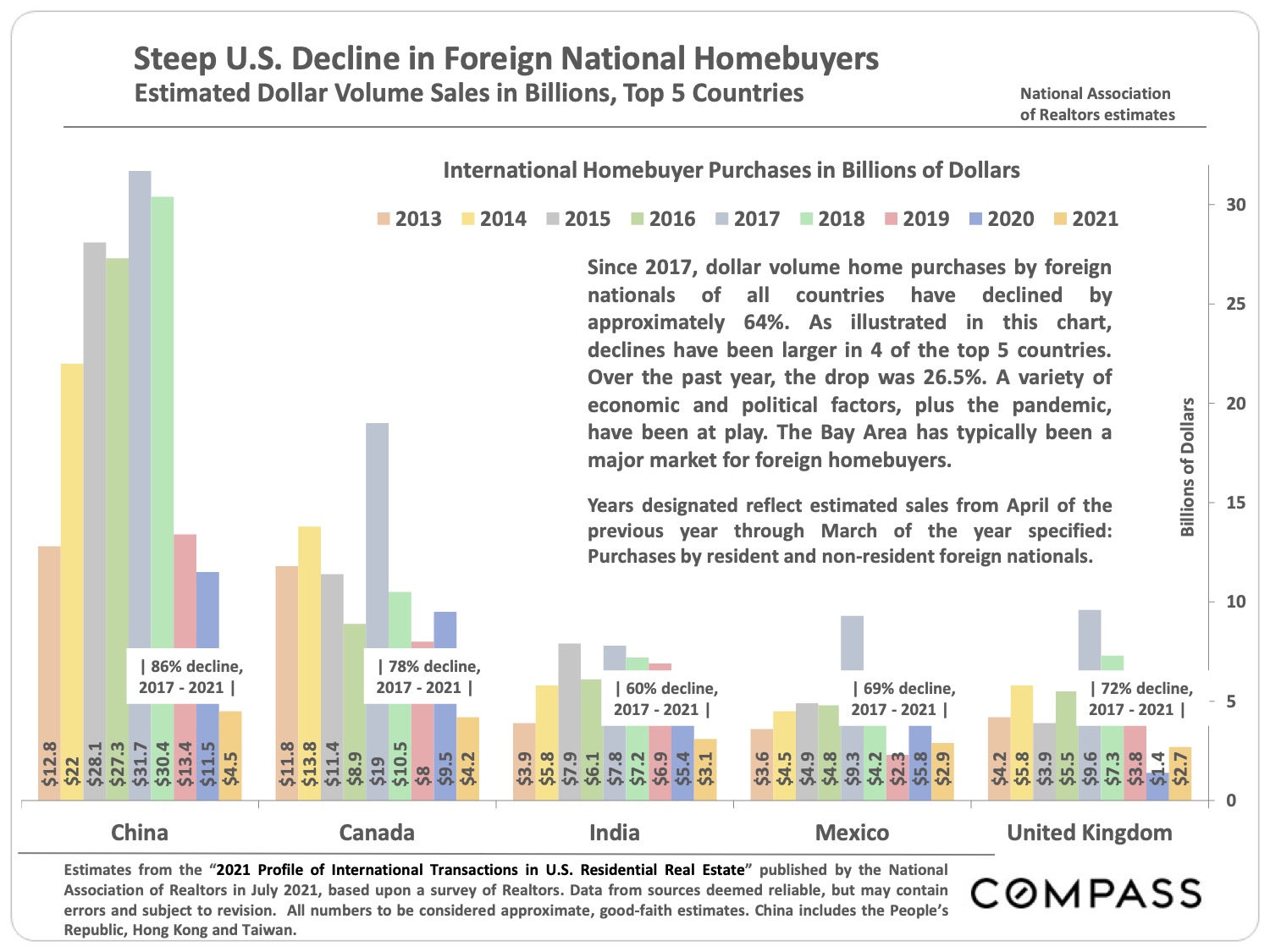

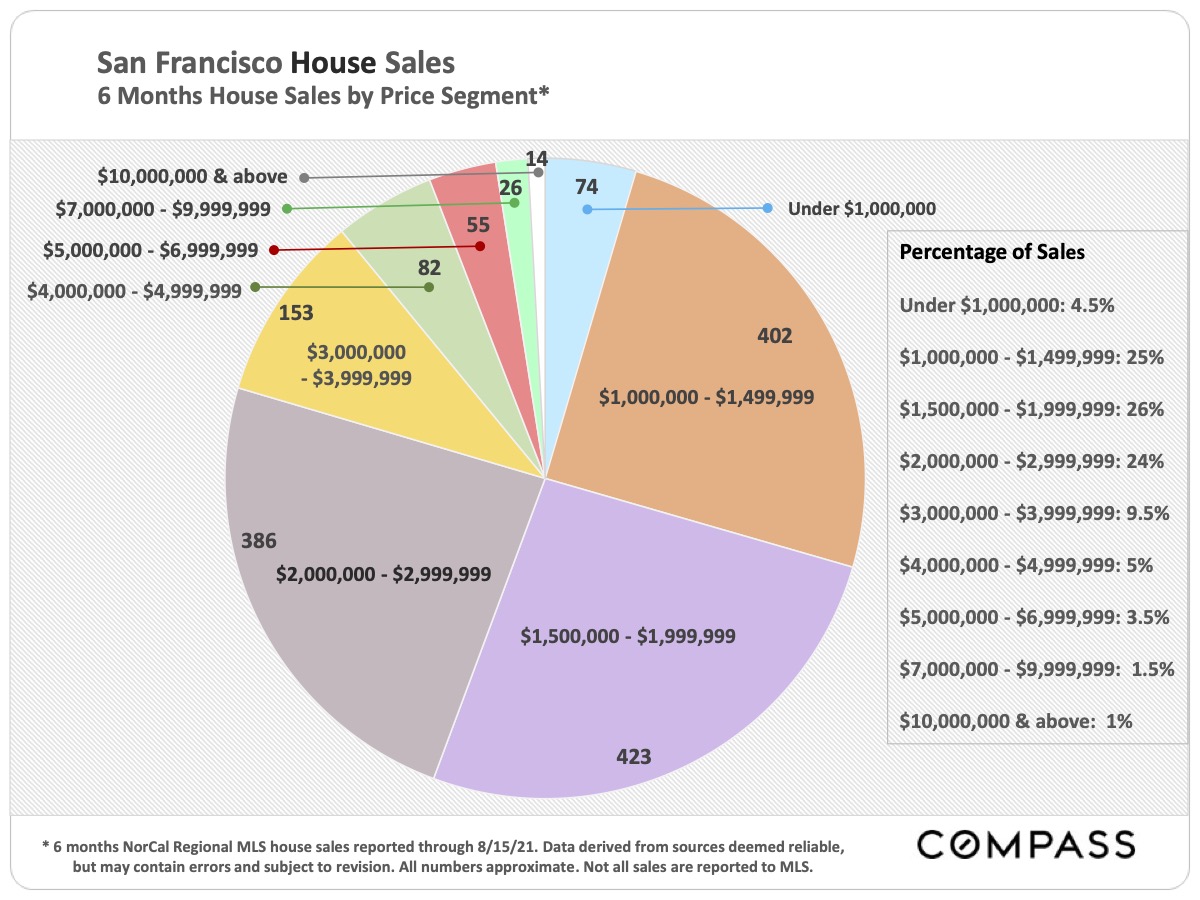

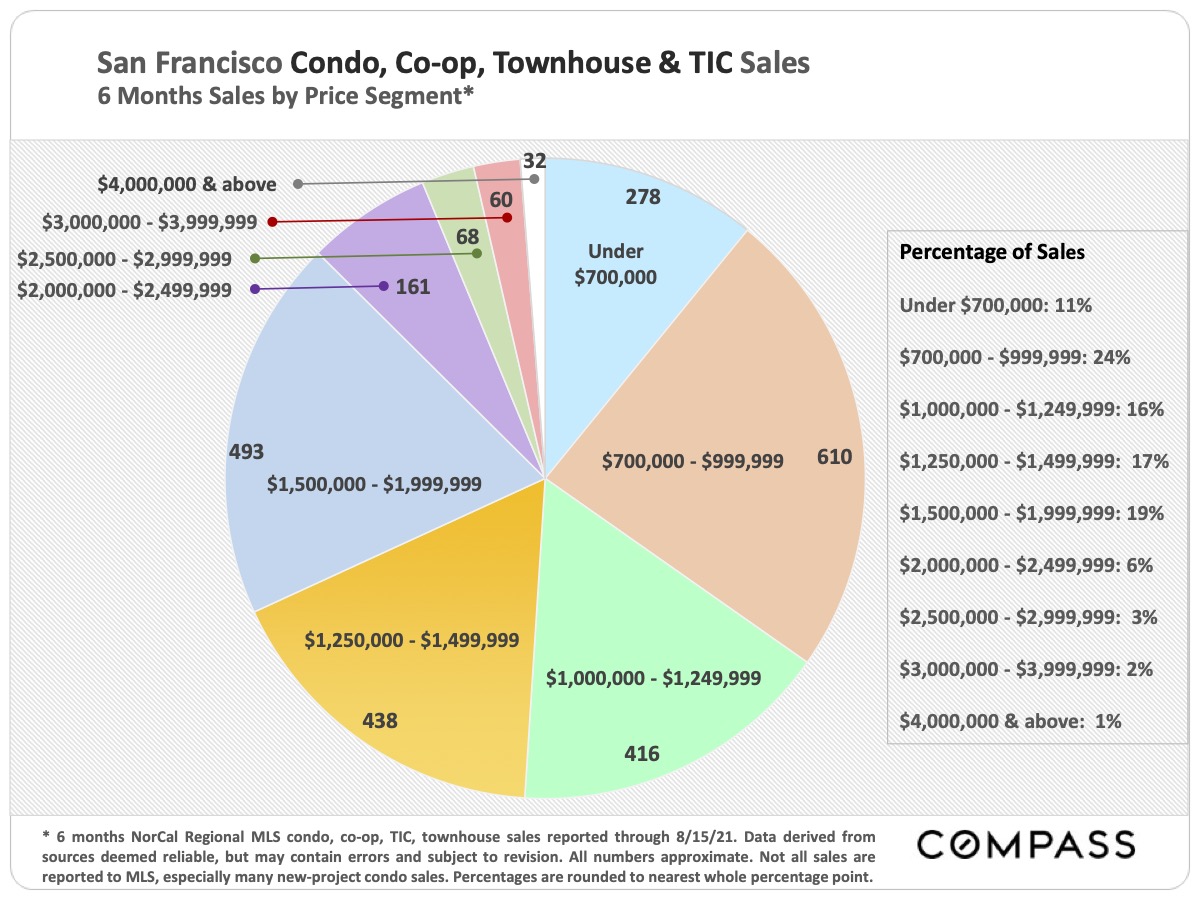

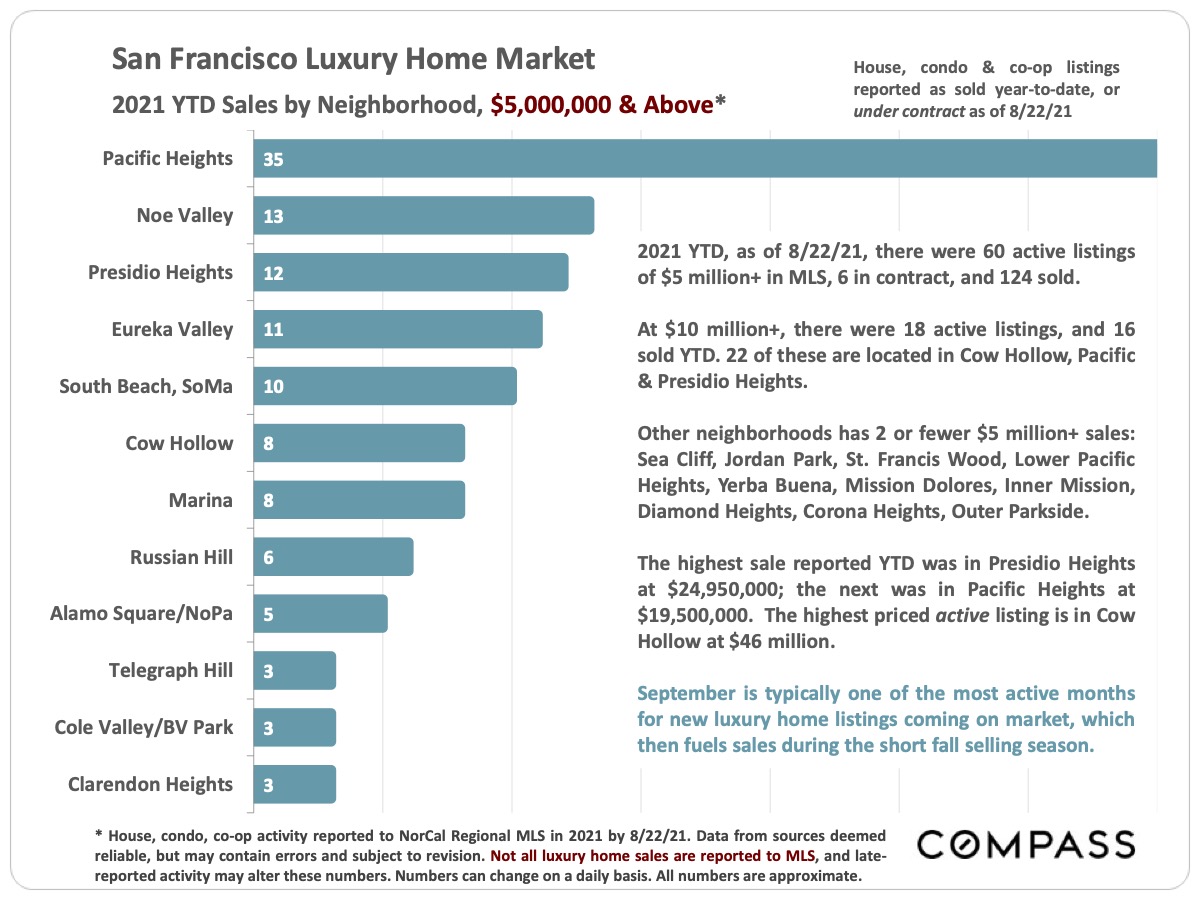

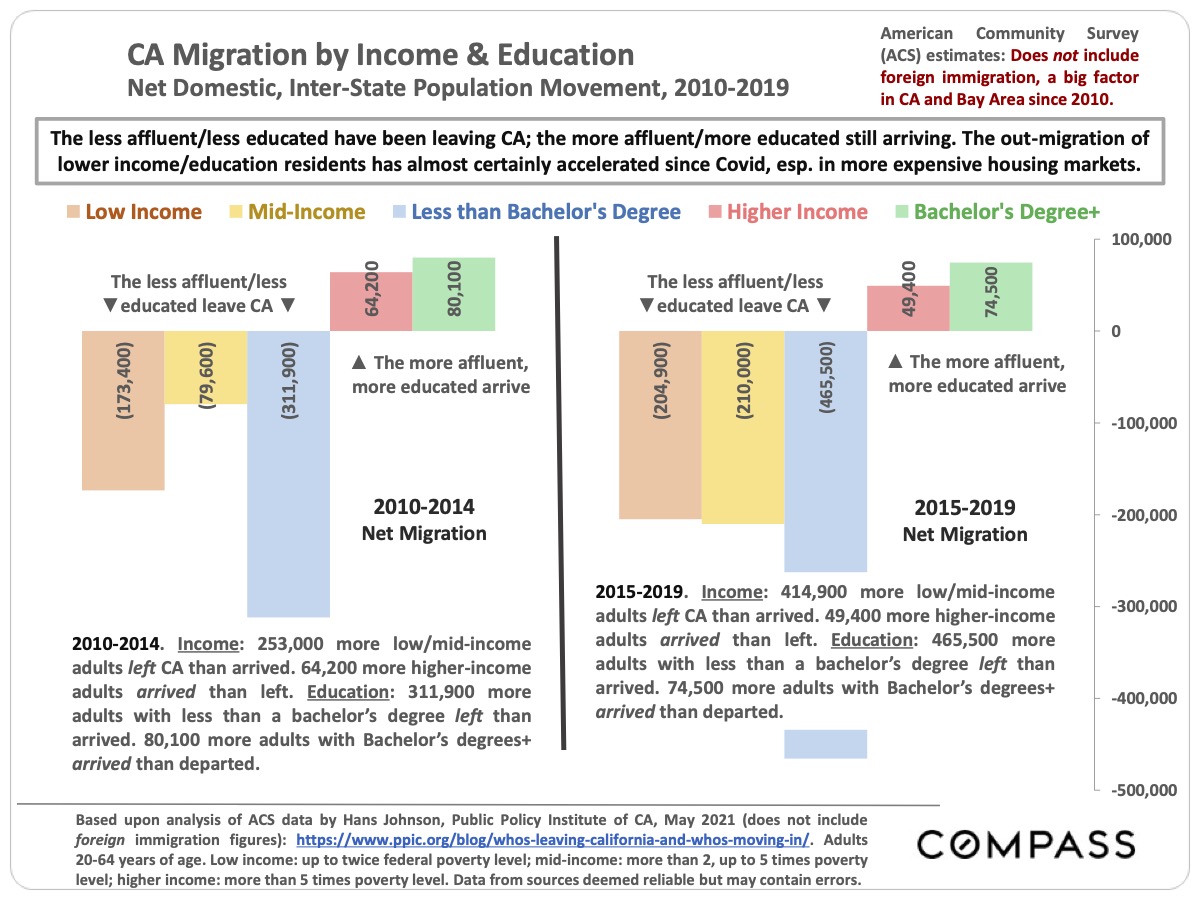

Demographic shifts: According to census data, many more less-affluent/less-educated residents left CA than have arrived in the 10 years through 2019, but more higher-income/more-educated residents arrived than departed. Out-migration accelerated in San Francisco since Covid hit, especially of less affluent residents – unemployment hit lower-wage jobs the hardest – though departures by affluent households seeking less densely populated locations also occurred. However, SF saw heightened demand for houses (with their yards and decks) by affluent and very affluent buyers competing for an inadequate supply of listings for sale. The condo market began a very dramatic rebound with the rollout of vaccines in 2021, hitting new highs is sales volume.

Statistics are generalities, essentially summaries of widely disparate data generated by dozens or hundreds of unique, individual sales occurring within different time periods. They are best seen not as precise measurements, but as broad, comparative indicators, with reasonable margins of error. Anomalous fluctuations in statistics are not uncommon, especially in smaller, expensive market segments. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers are approximate. Data from MLS, but not all listings or sales are reported to MLS.

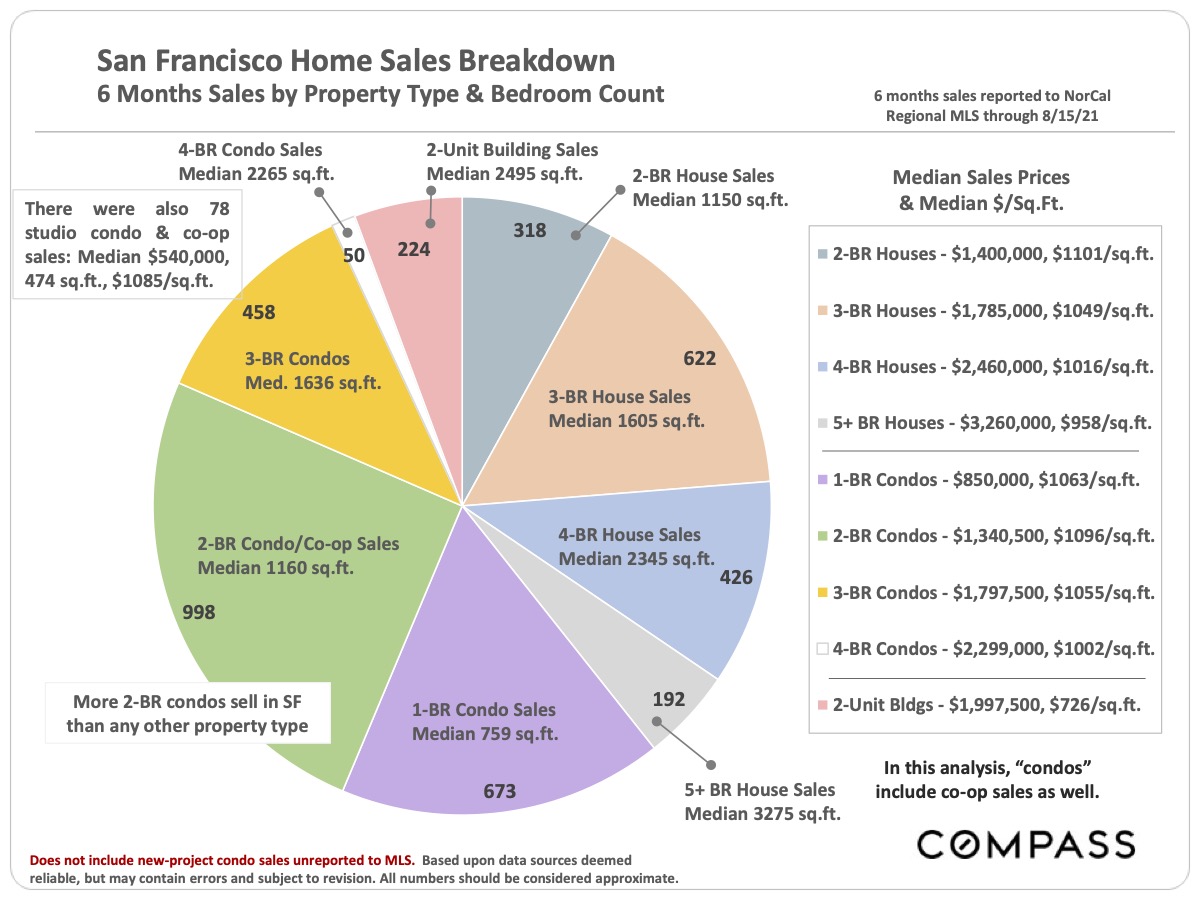

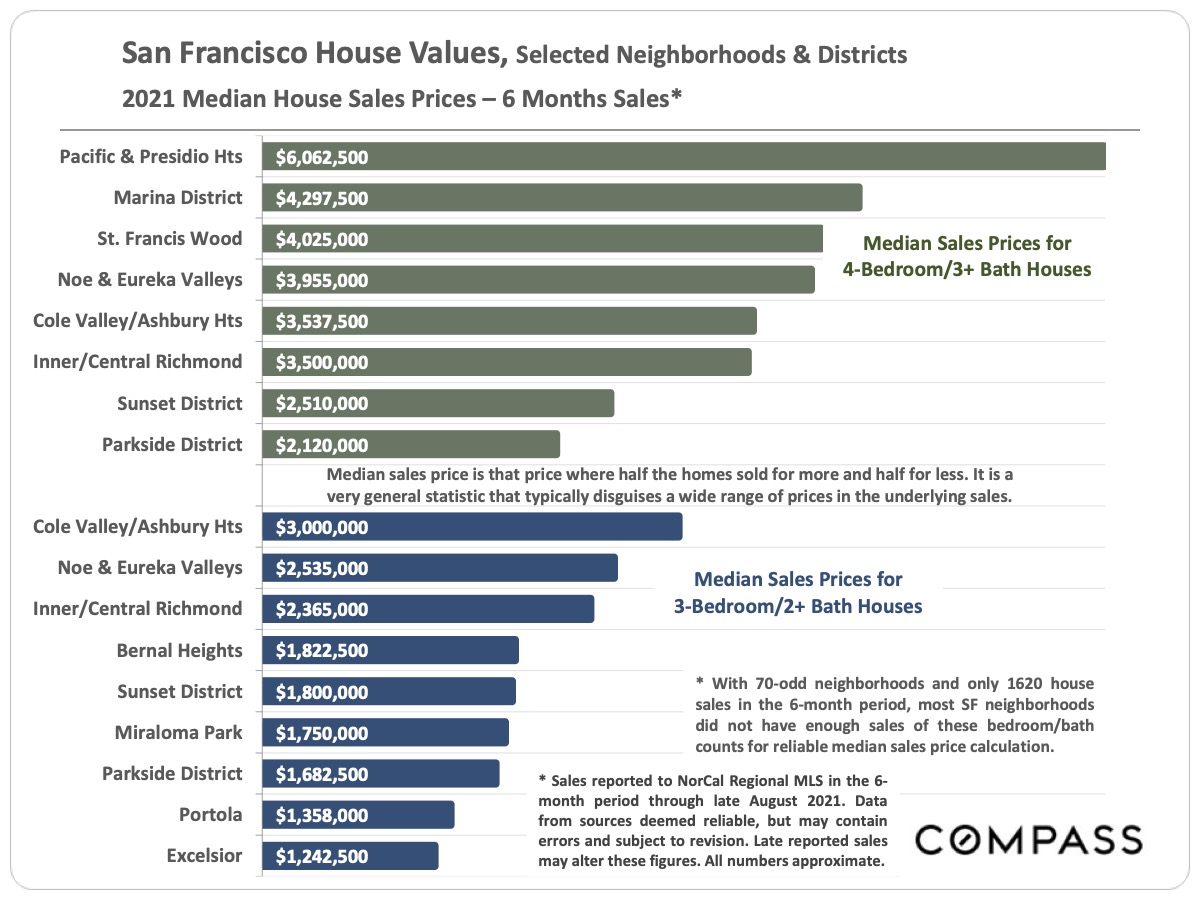

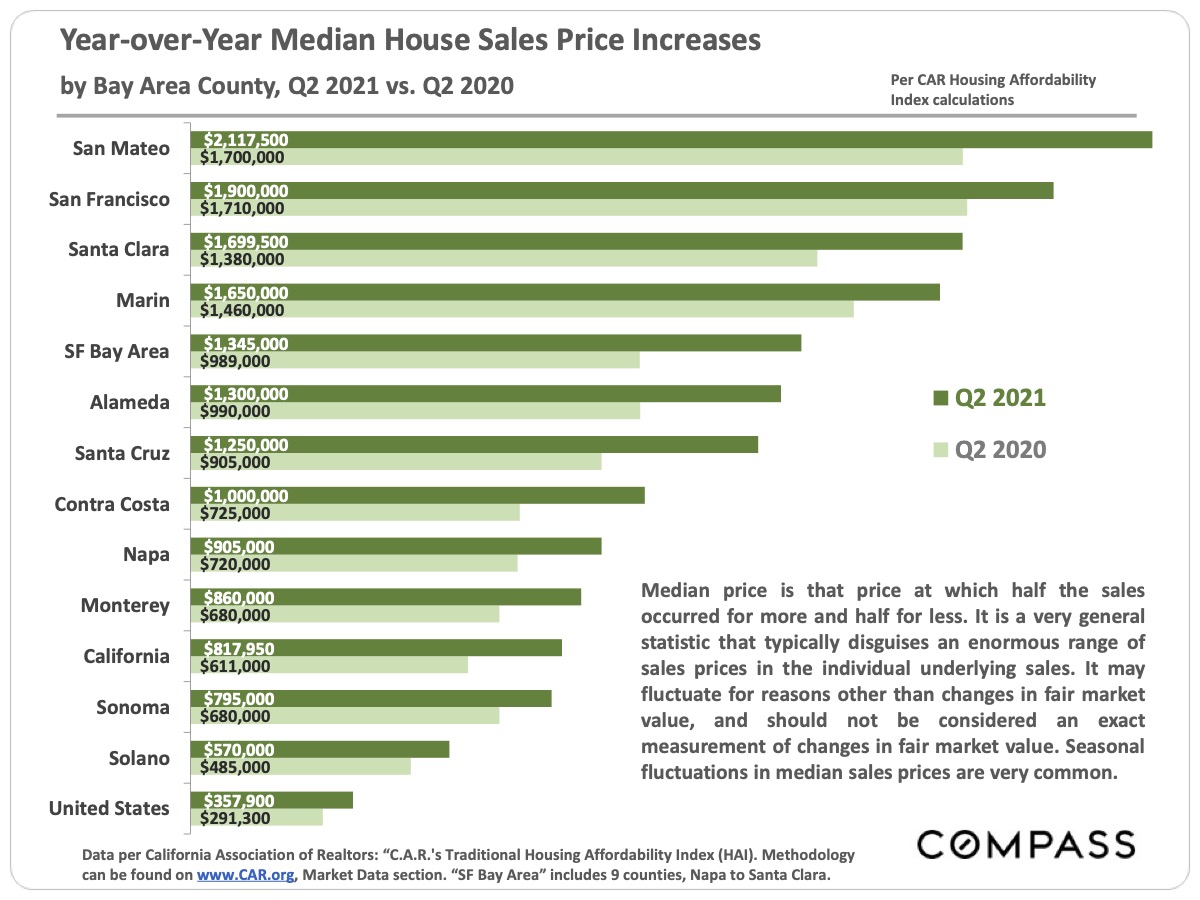

Median Sales Price is that price at which half the properties sold for more and half for less. It may be affected by seasonality, “unusual” events, or changes in inventory and buying trends, as well as by changes in fair market value. The median sales price for an area will often conceal an enormous variety of sales prices in the underlying individual sales.

Dollar per Square Foot is based upon the home’s interior living space and does not include garages, unfinished attics and basements, rooms built without permit, patios, decks or yards (though all those can add value to a home). These figures are usually derived from appraisals or tax records, but are sometimes unreliable (especially for older homes) or unreported altogether. The calculation can only be made on those home sales that reported square footage.

Many aspects of value cannot be adequately reflected in median and average statistics: curb appeal, age, condition, amenities, views, lot size, quality of outdoor space, “bonus” rooms, additional parking, quality of location within the neighborhood, and so forth. How these statistics apply to any particular home is unknown without a specific comparative market analysis.

Compass is a real estate broker licensed by the State of California, DRE 01527235. Equal Housing Opportunity. This report has been prepared solely for information purposes. The information herein is based on or derived from information generally available to the public and/or from sources believed to be reliable. No representation or warranty can be given with respect to the accuracy or completeness of the information. Compass disclaims any and all liability relating to this report, including without limitation any express or implied representations or warranties for statements contained in, and omissions from, the report. Nothing contained herein is intended to be or should be read as any regulatory, legal, tax, accounting or other advice and Compass does not provide such advice. All opinions are subject to change without notice. Compass makes no representation regarding the accuracy of any statements regarding any references to the laws, statutes or regulations of any state are those of the author(s). Past performance is no guarantee of future results.