San Francisco Real Estate Market Report – October 2022

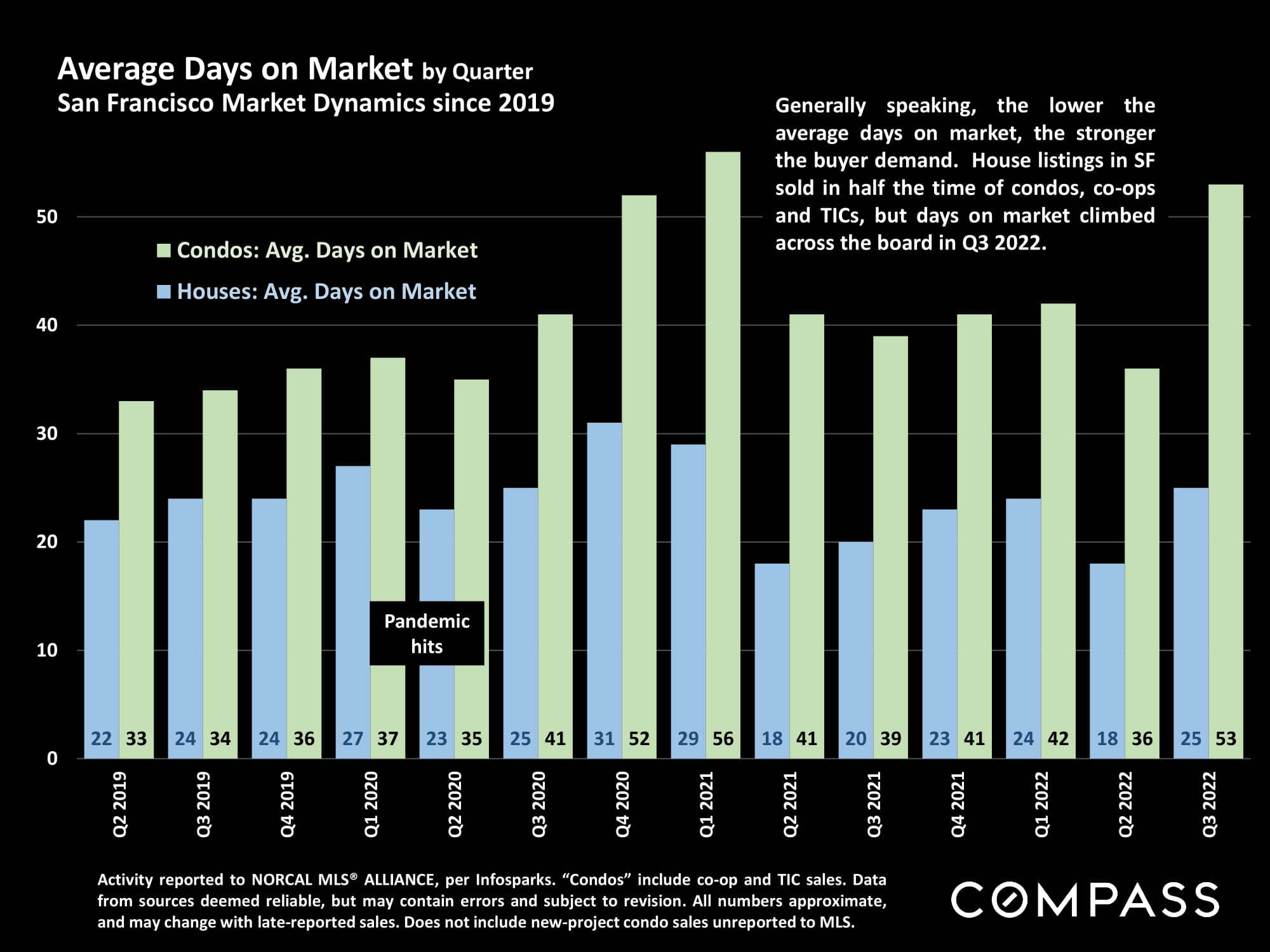

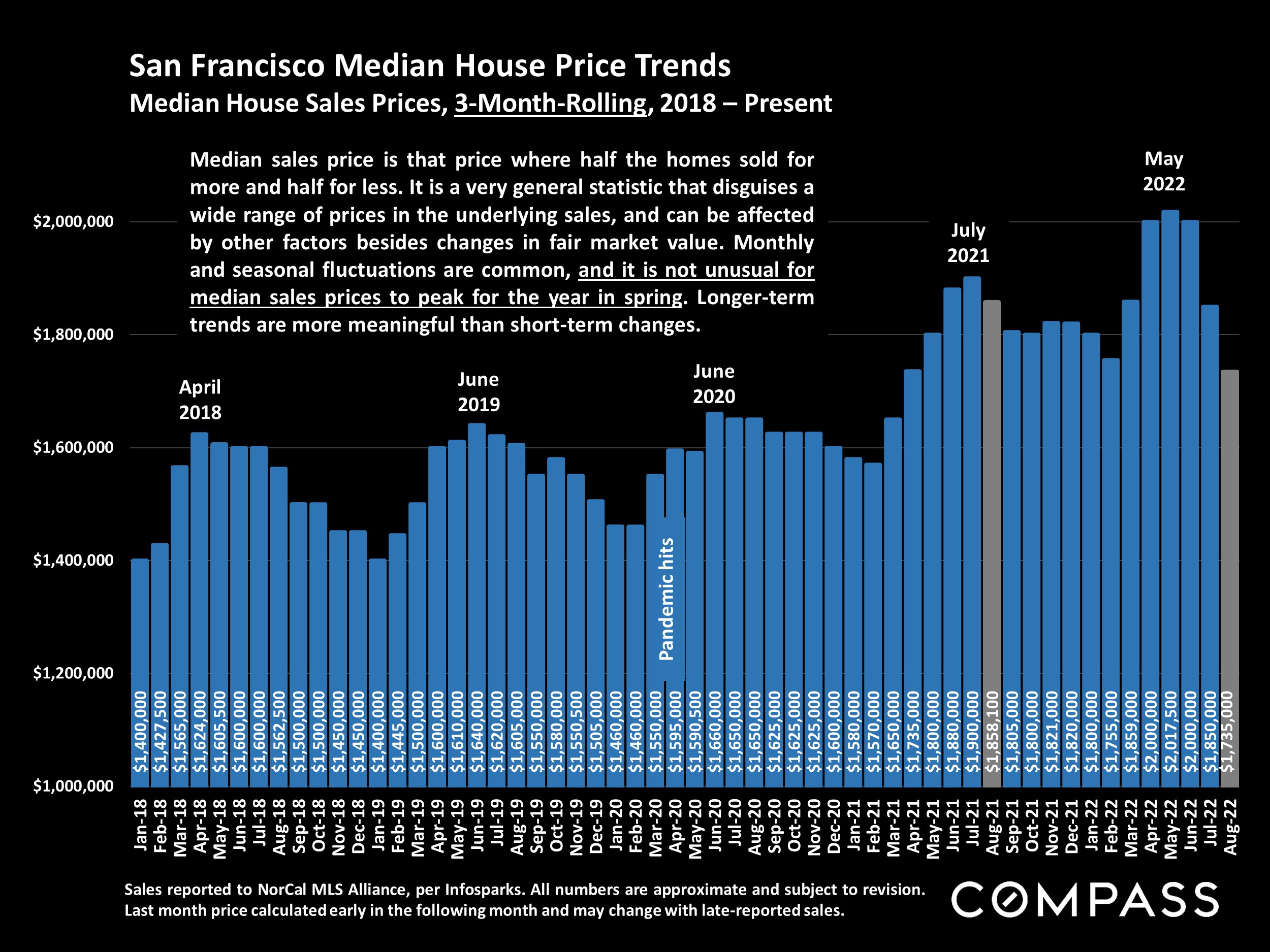

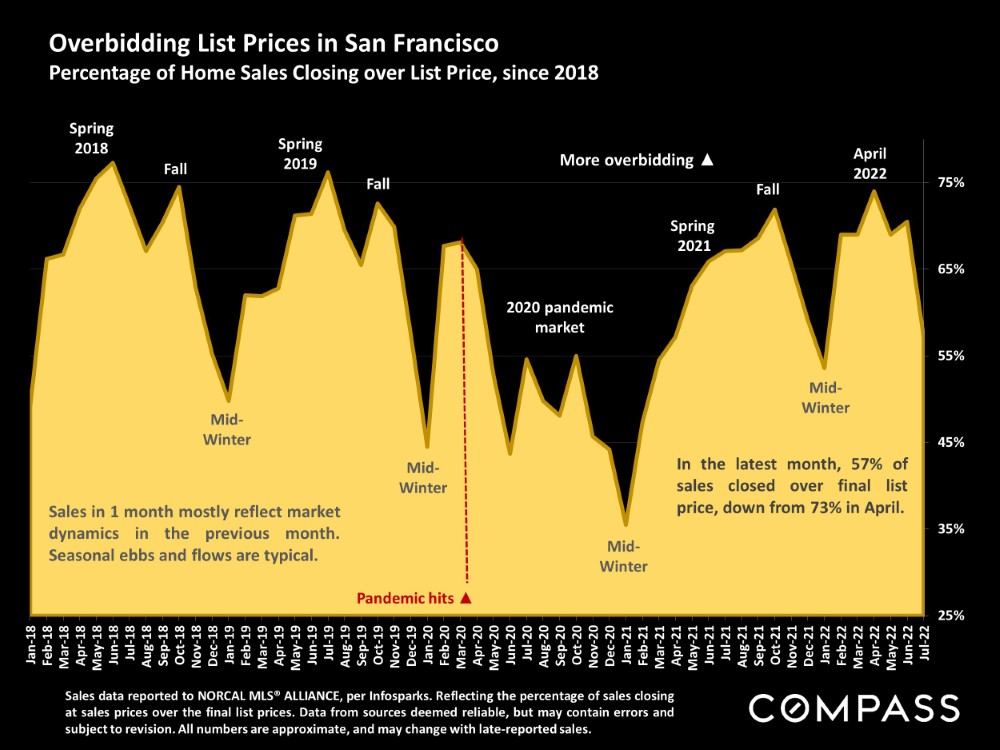

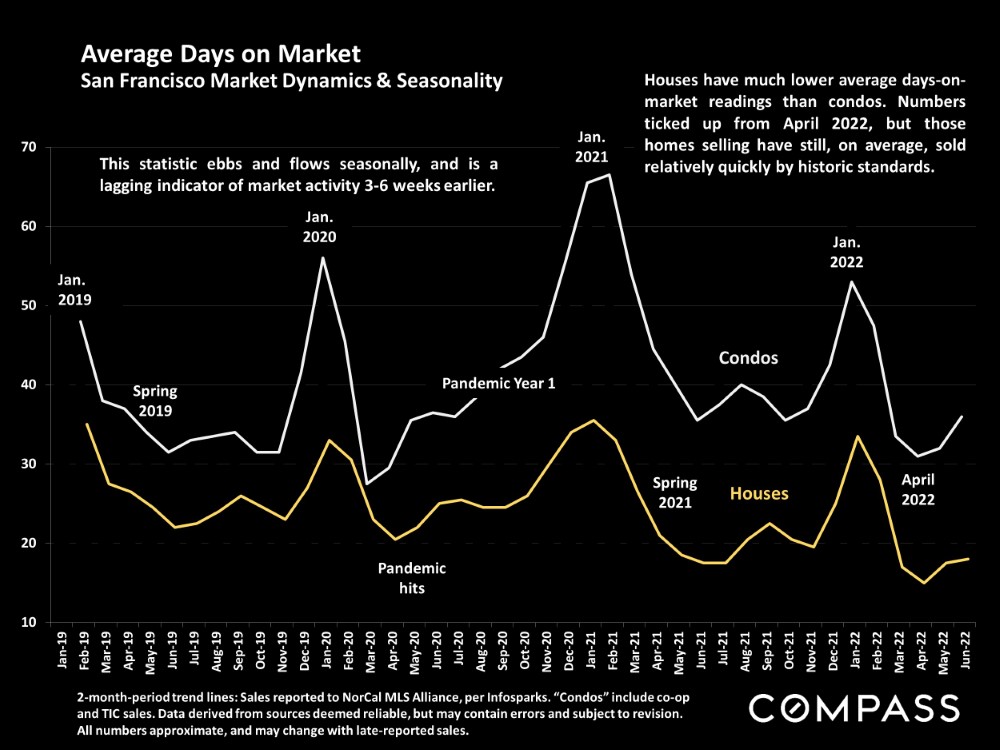

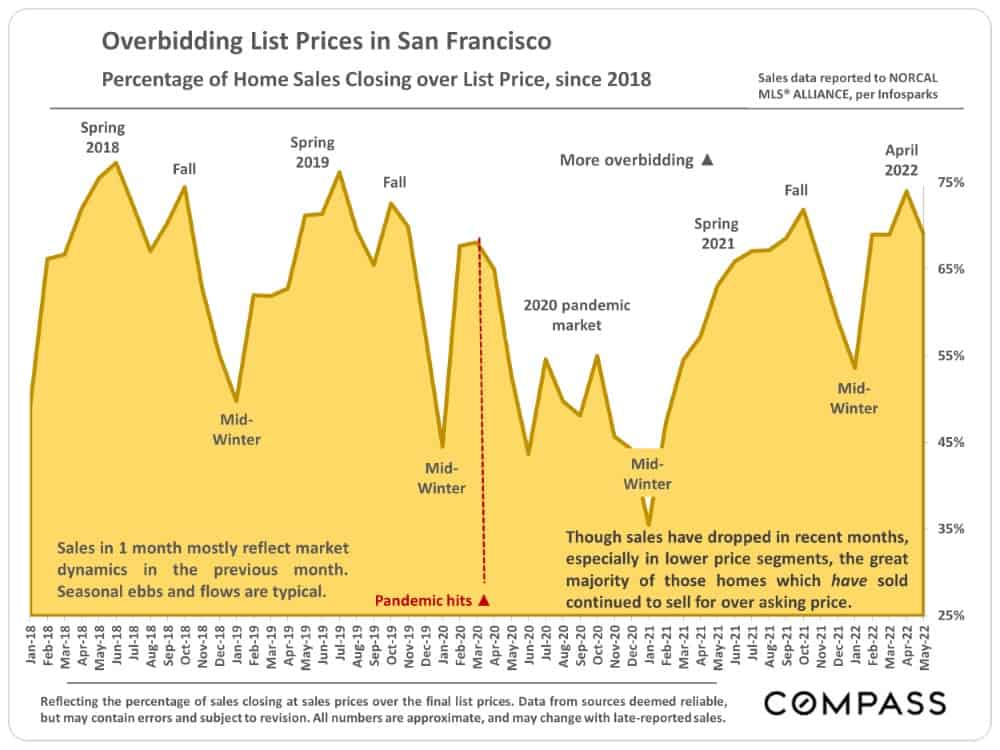

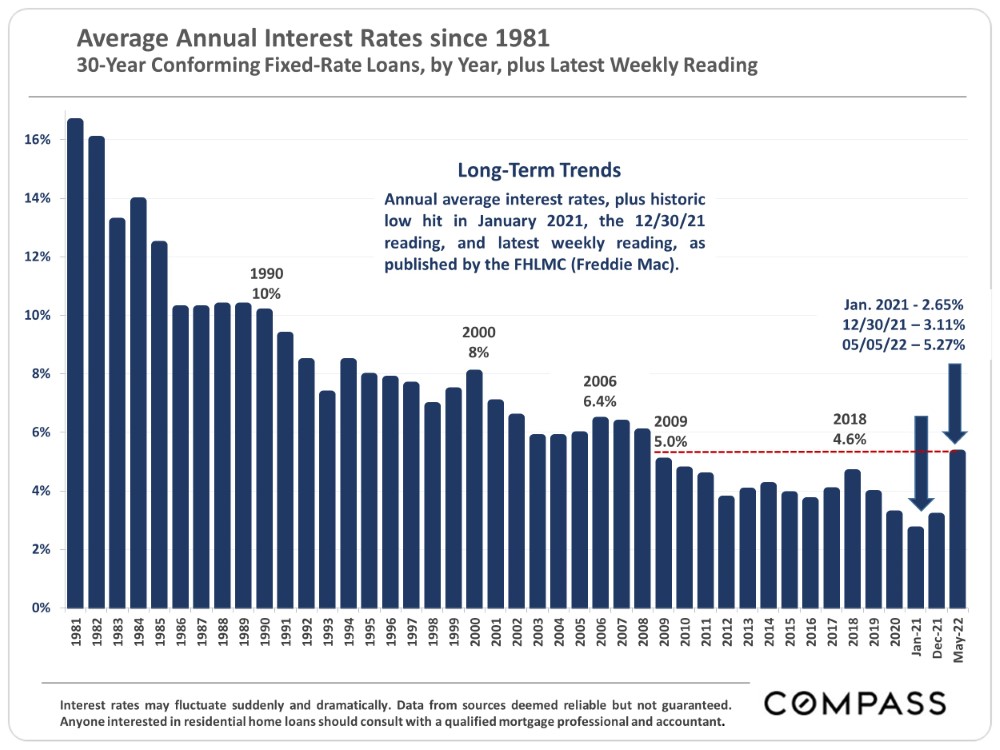

San Francisco Real Estate Market Report - October 2022 Virtually across the Bay Area, Q3 median sales prices retreated dramatically from their spring peaks, and SF was hit harder than most area [...]