San Francisco Real Estate Market Report – October 2022

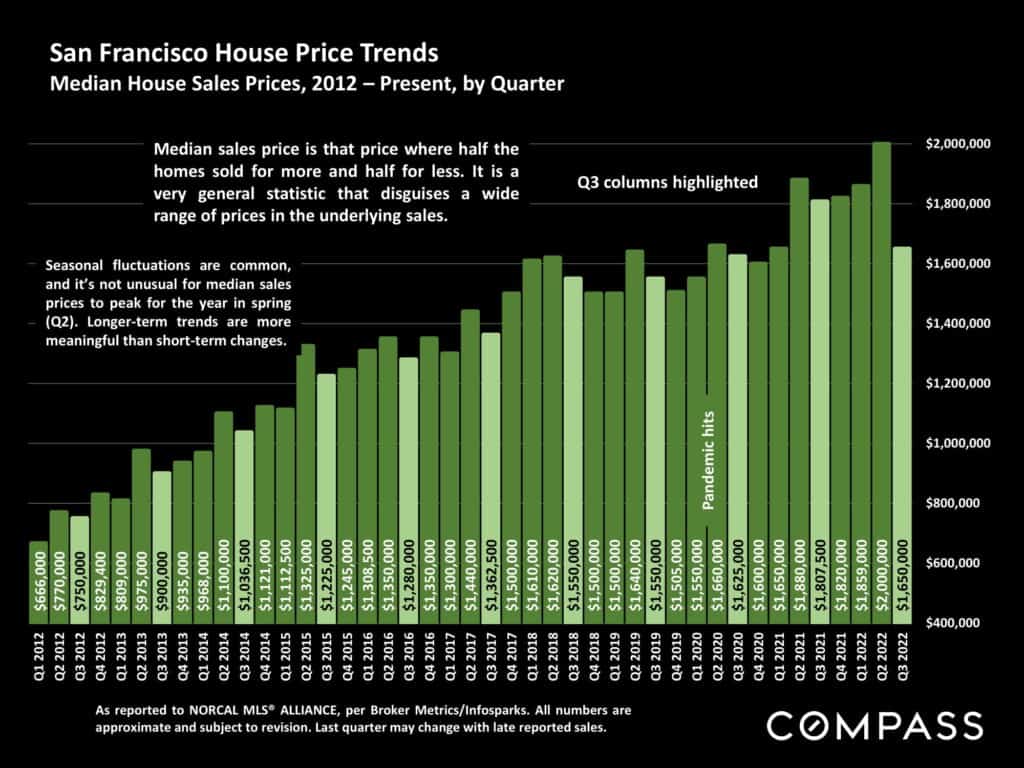

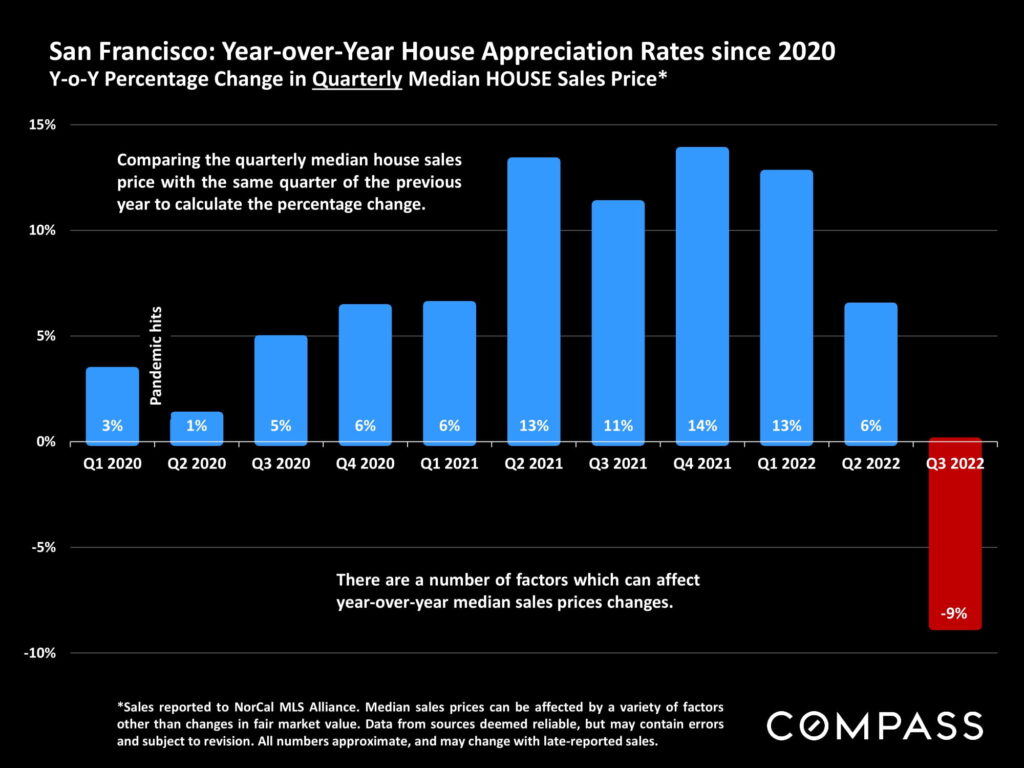

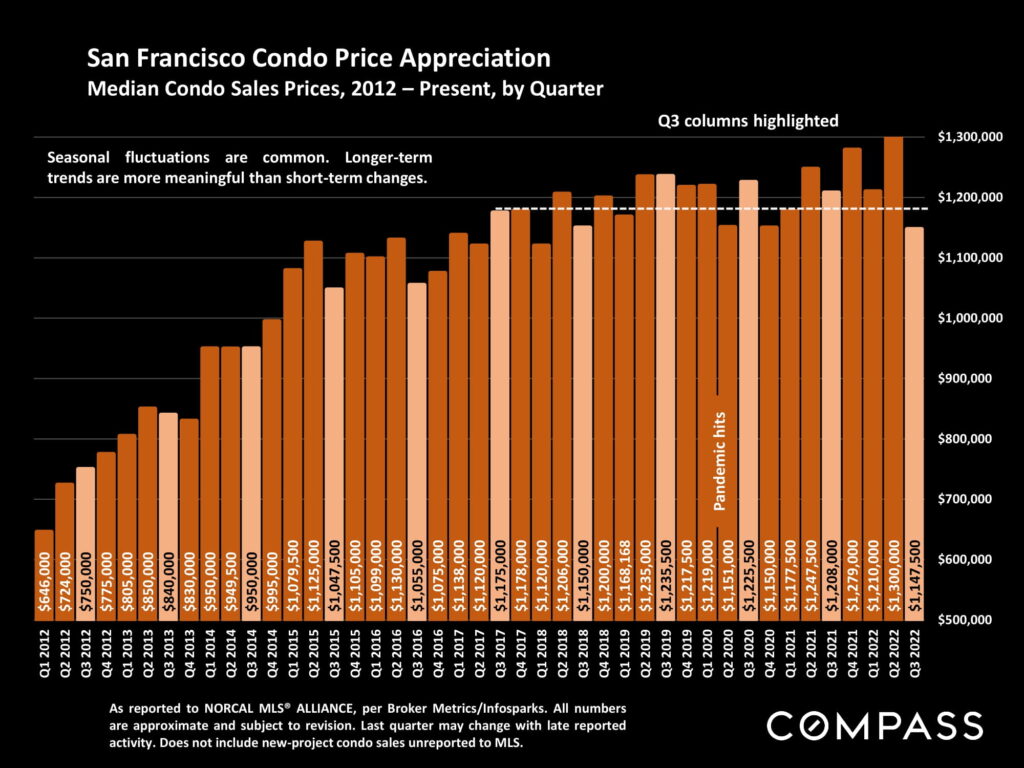

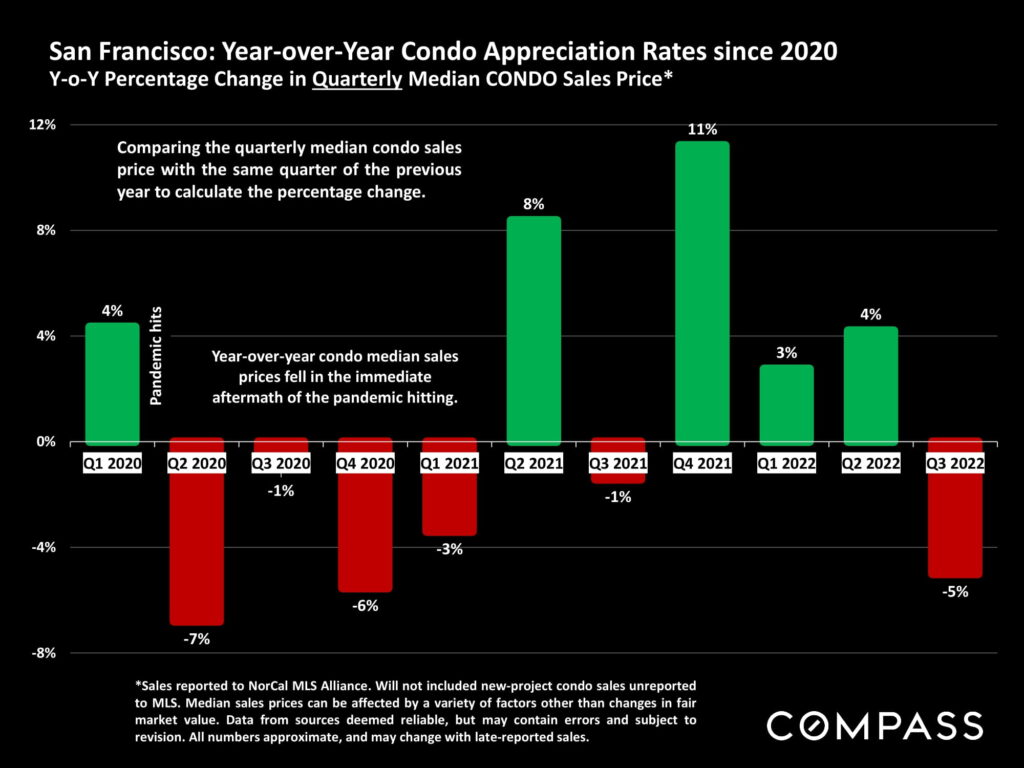

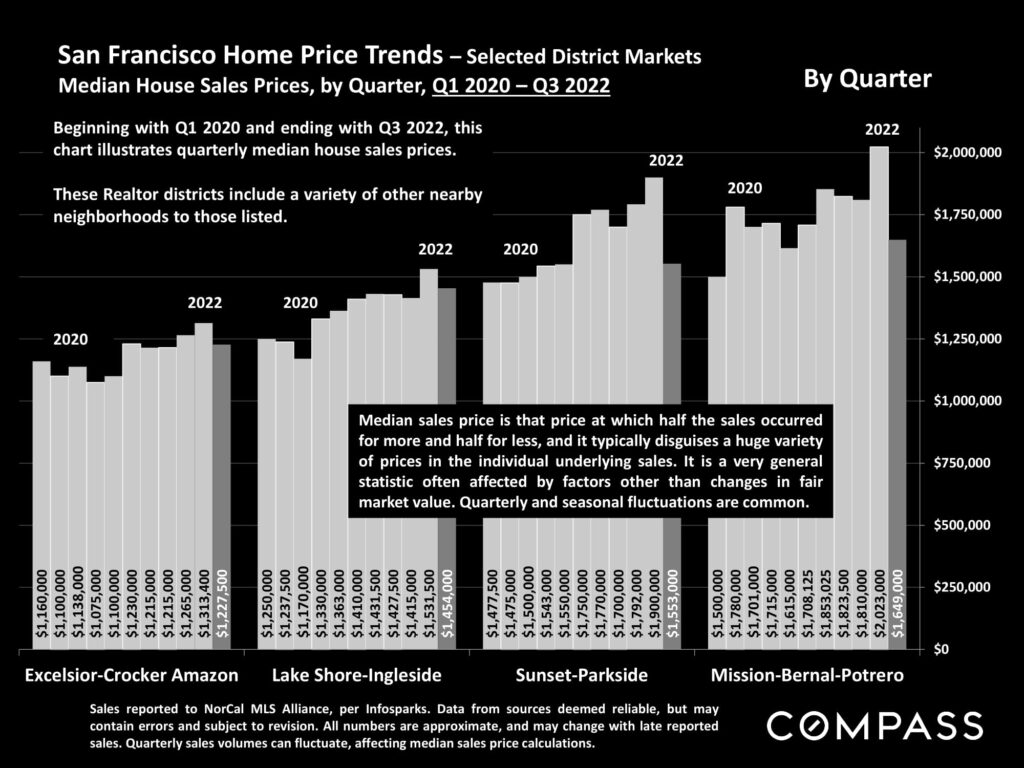

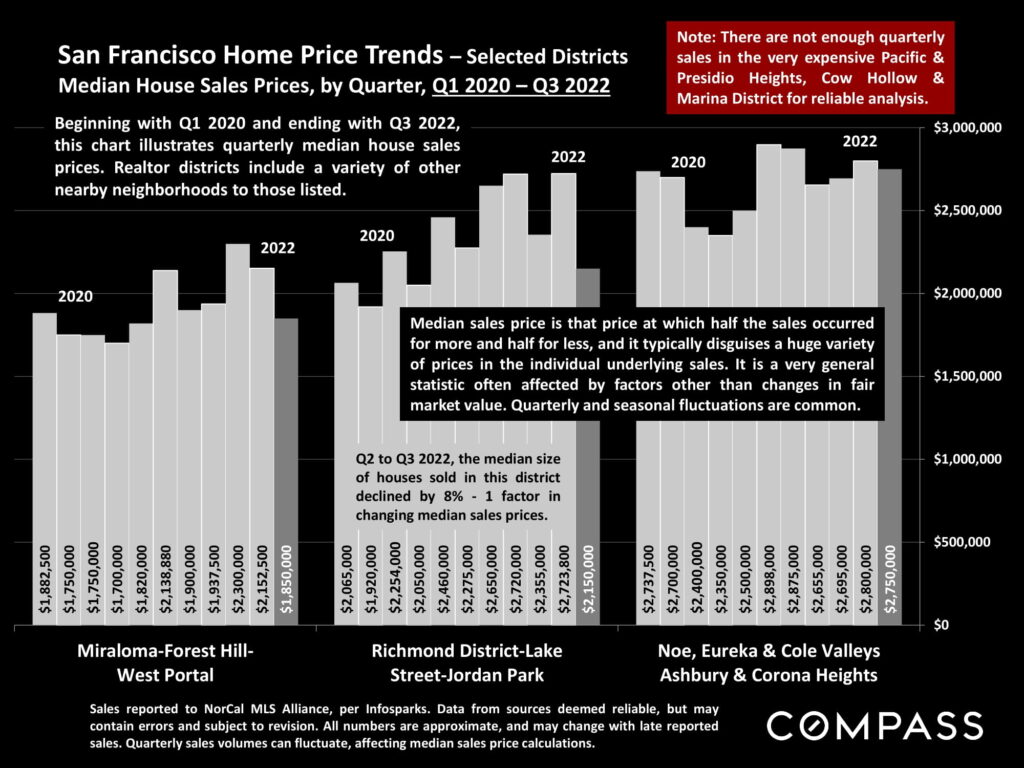

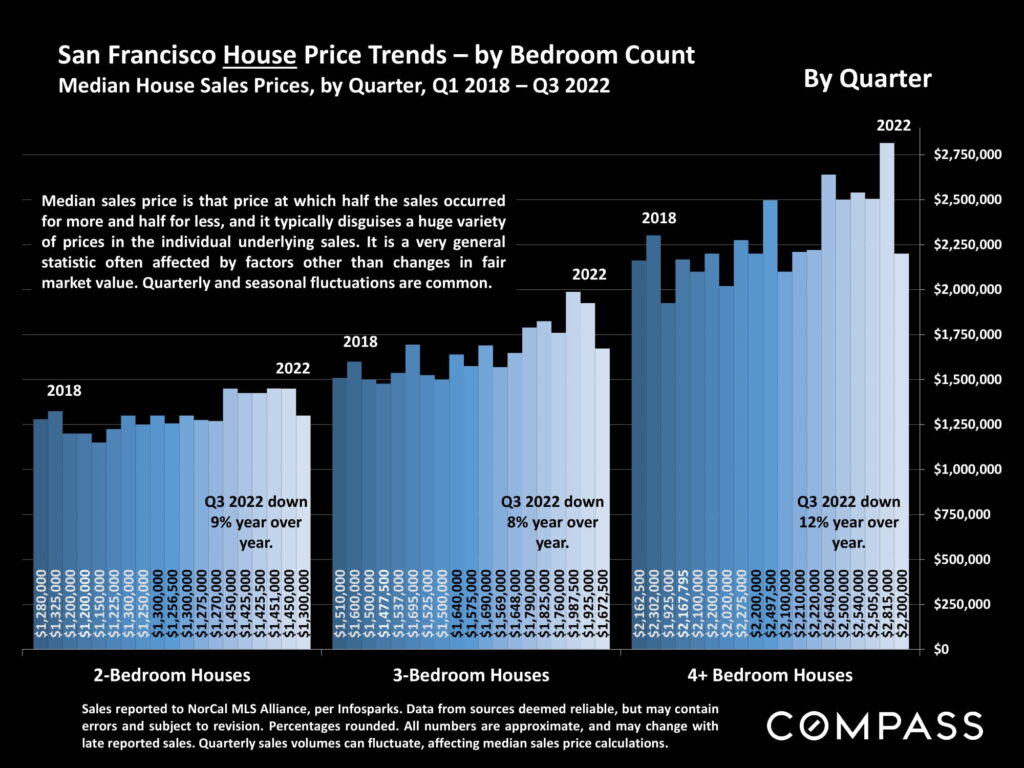

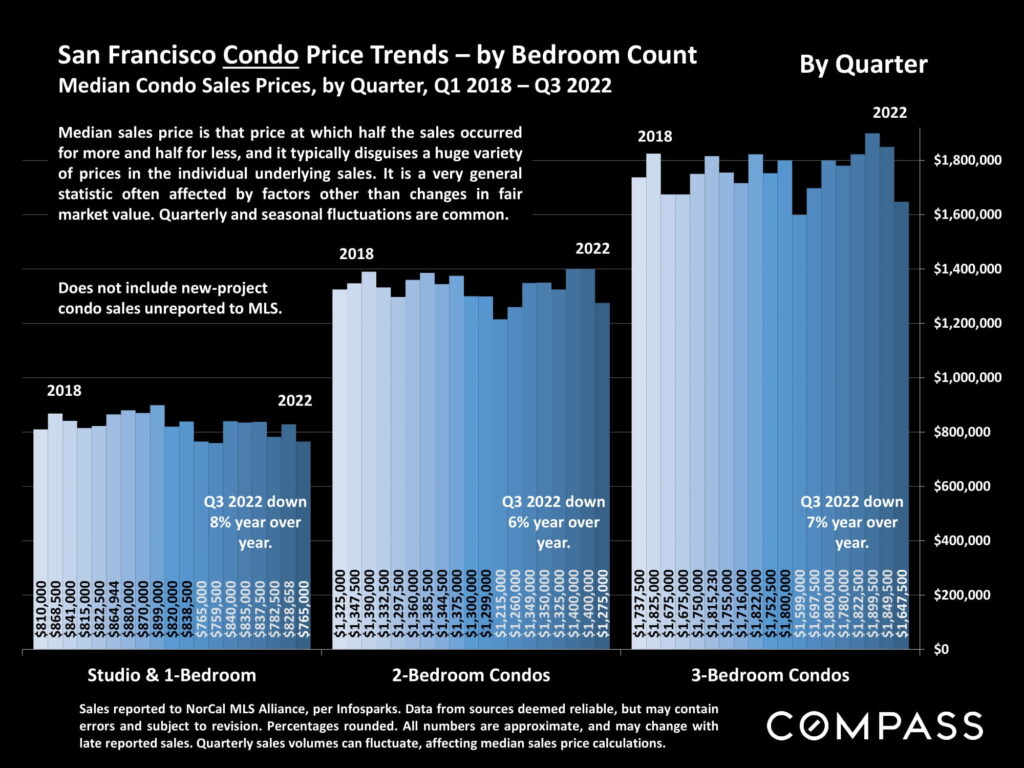

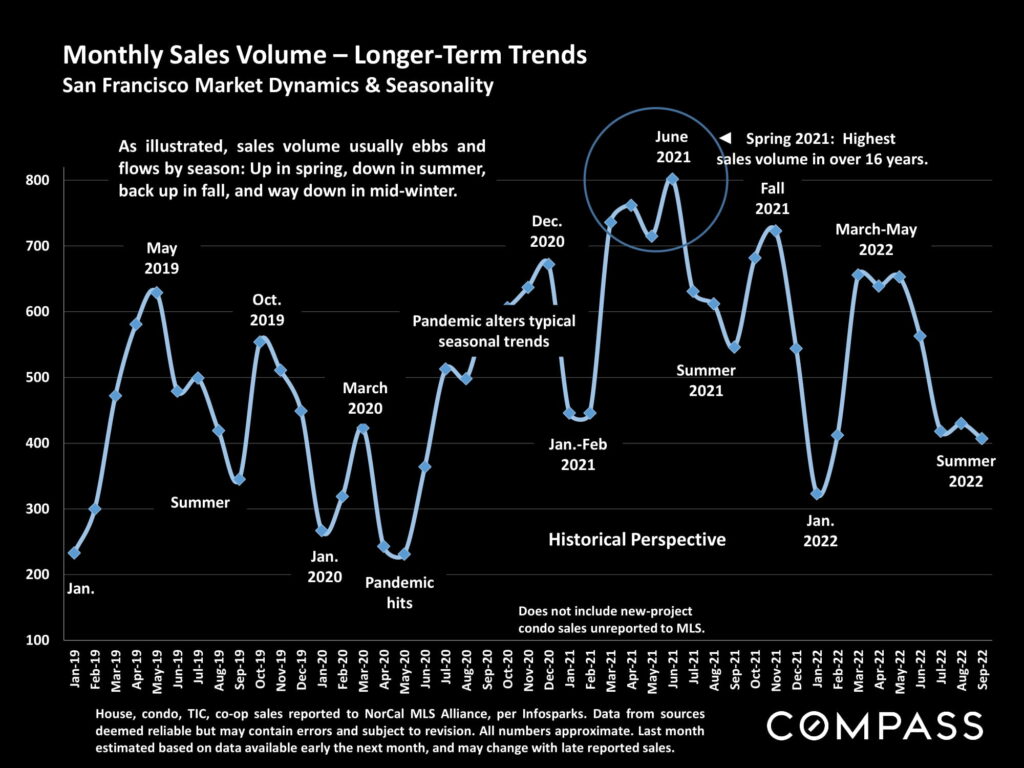

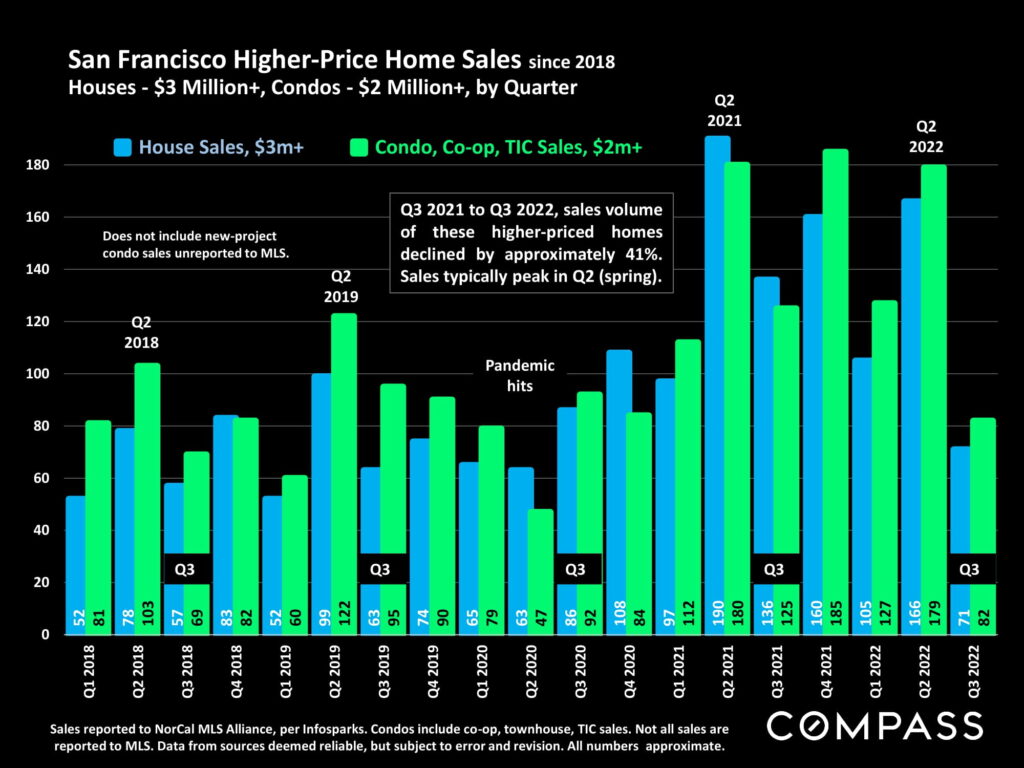

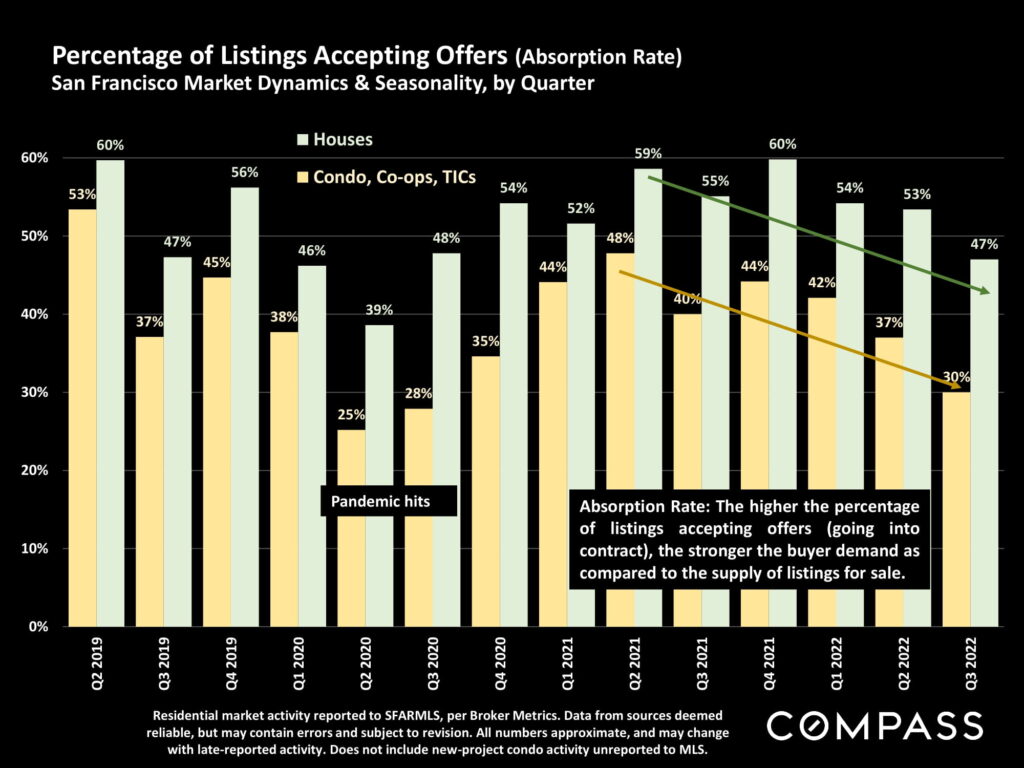

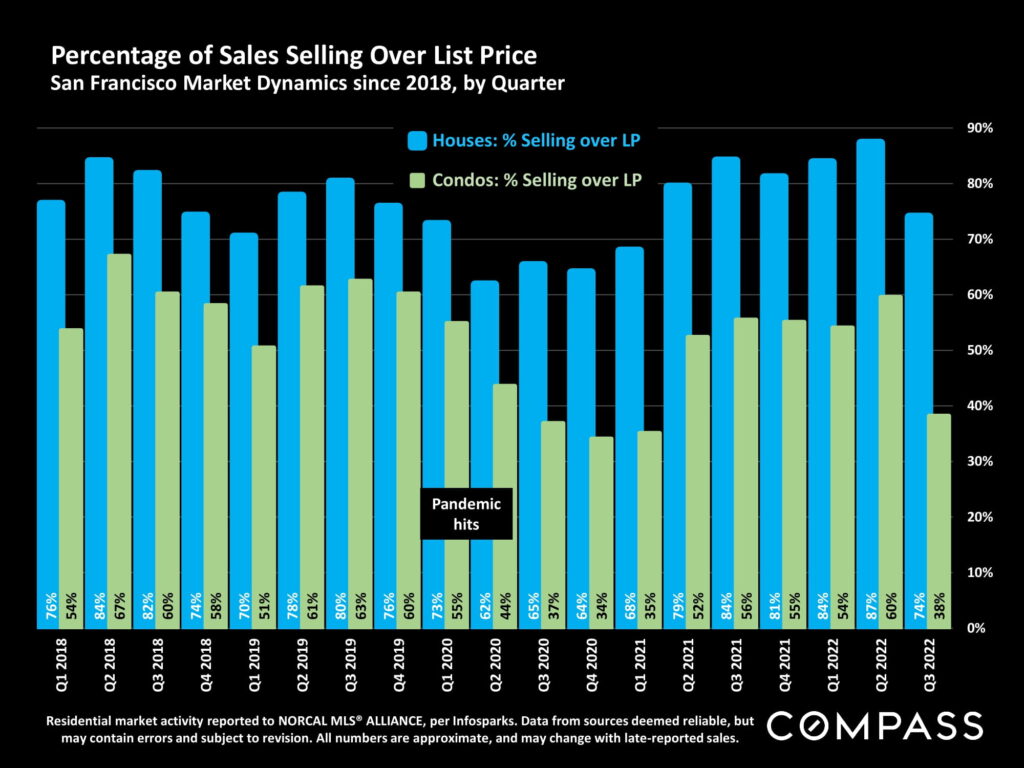

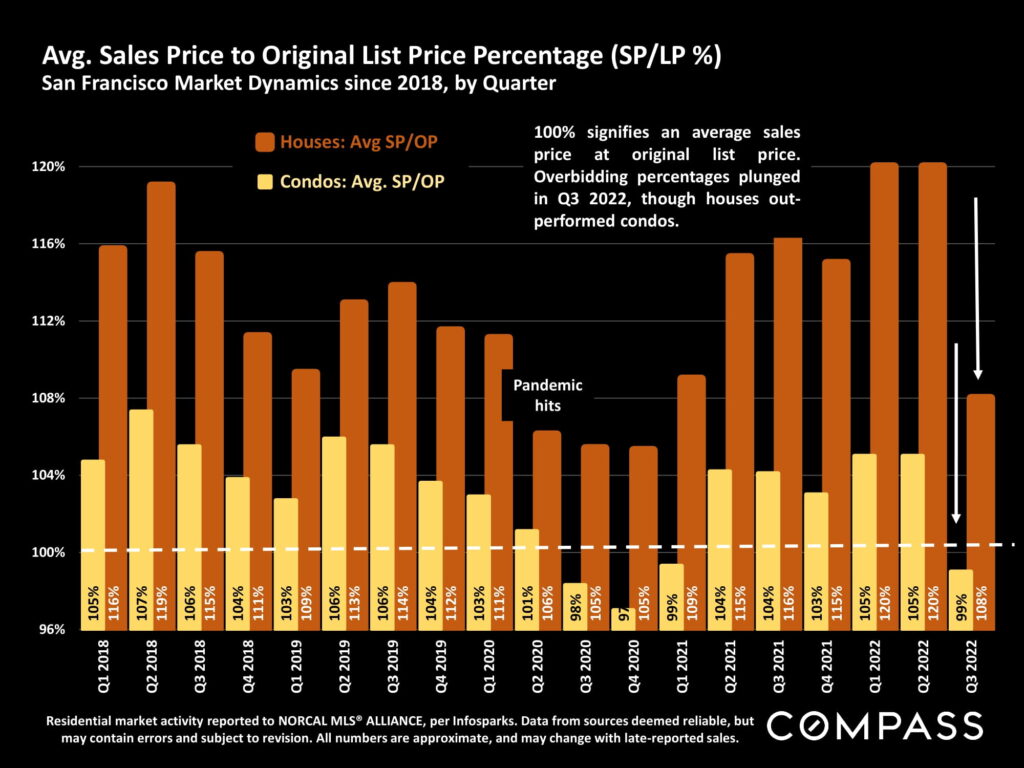

Virtually across the Bay Area, Q3 median sales prices retreated dramatically from their spring peaks, and SF was

hit harder than most area markets. Part of this was due to seasonal trends – median sales prices often peak for

the calendar year in Q2, then drop in summer – but part of the decline was clearly due to changing market

conditions prompted by shifts in interest rates, inflation, stock markets, and consumer confidence. In this report,

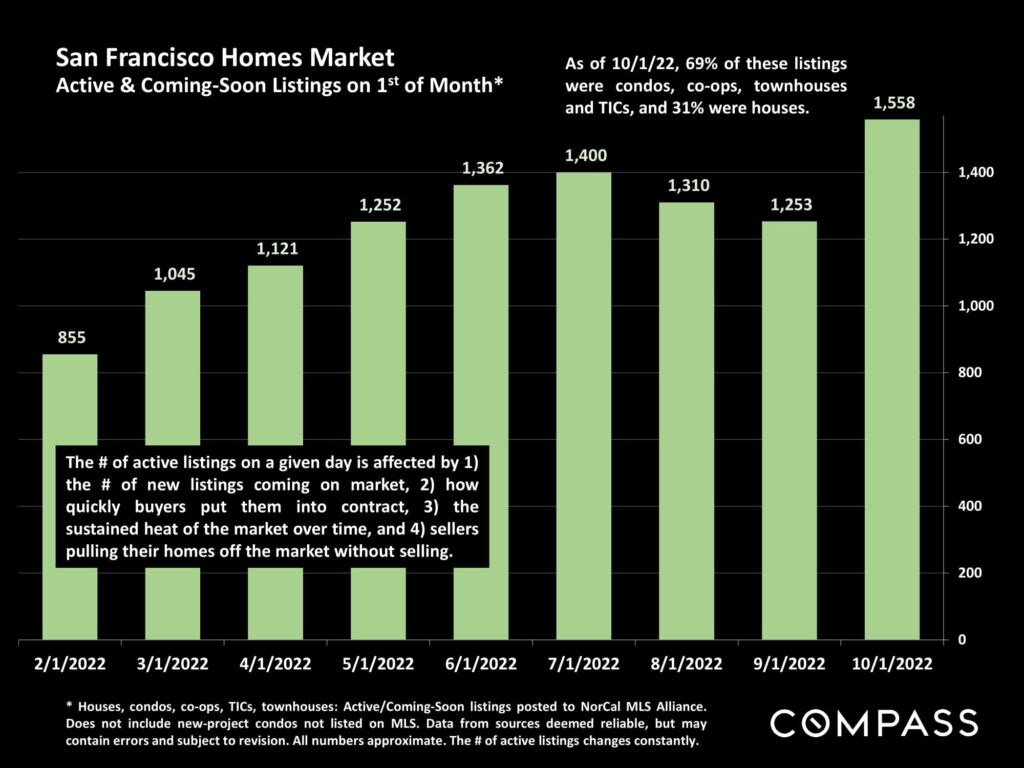

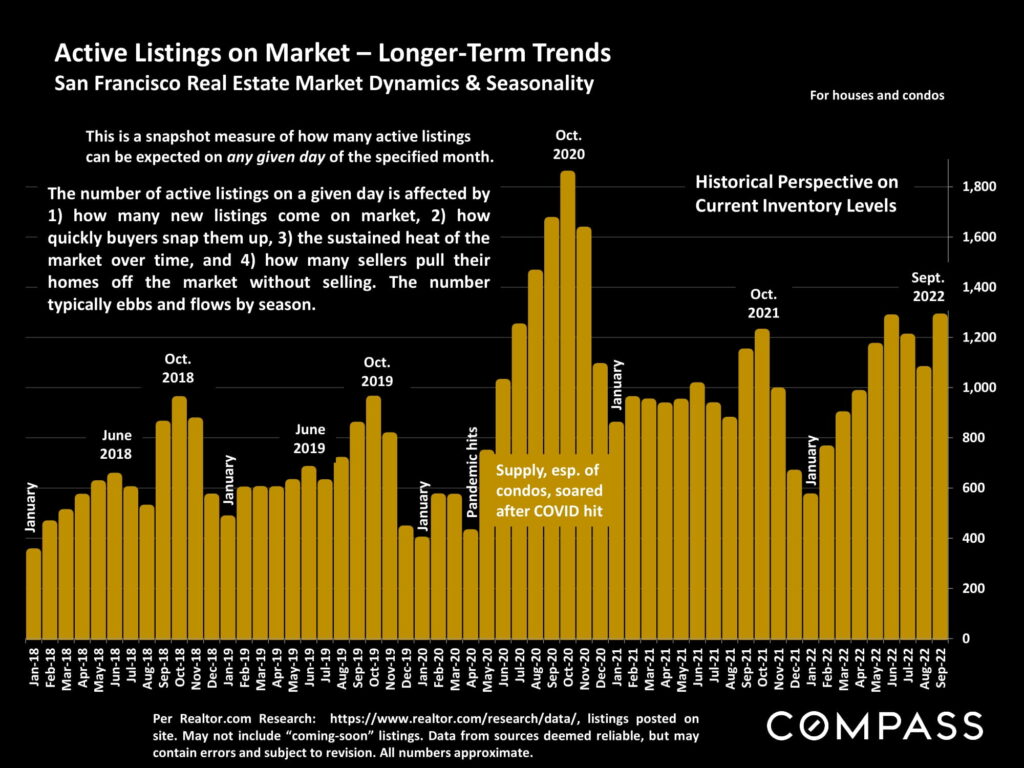

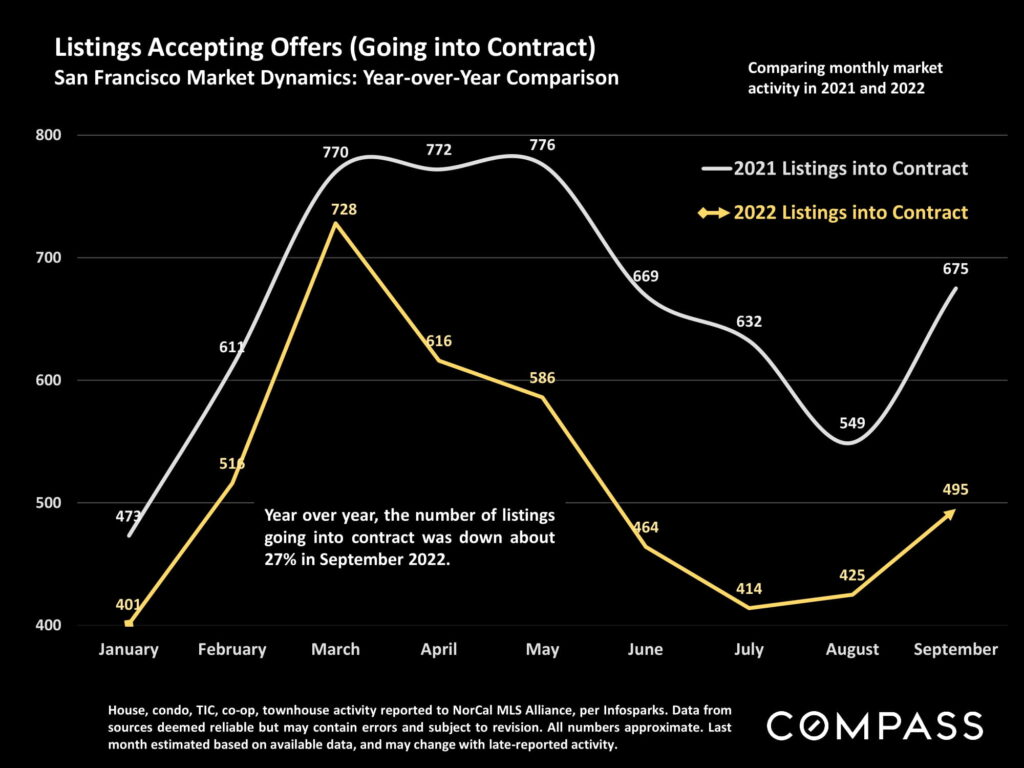

home prices will be reviewed from a variety of angles to provide greater context. On the supply and demand

side, it appears that after the big drop in demand in early-mid summer, conditions have mostly stabilized:

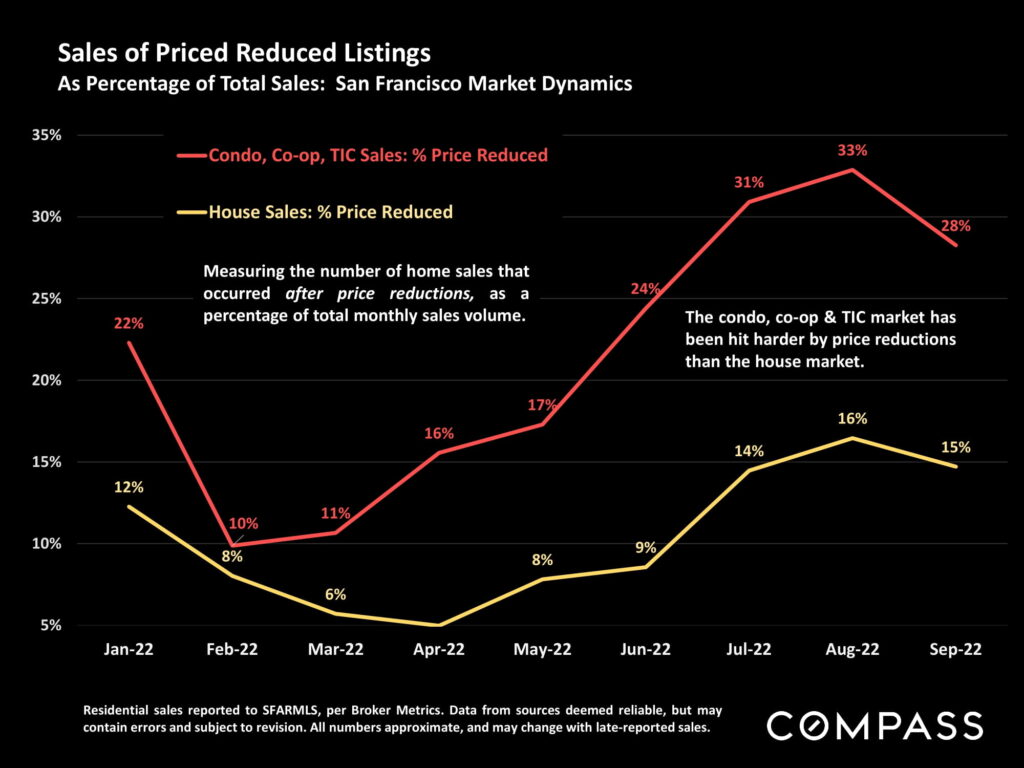

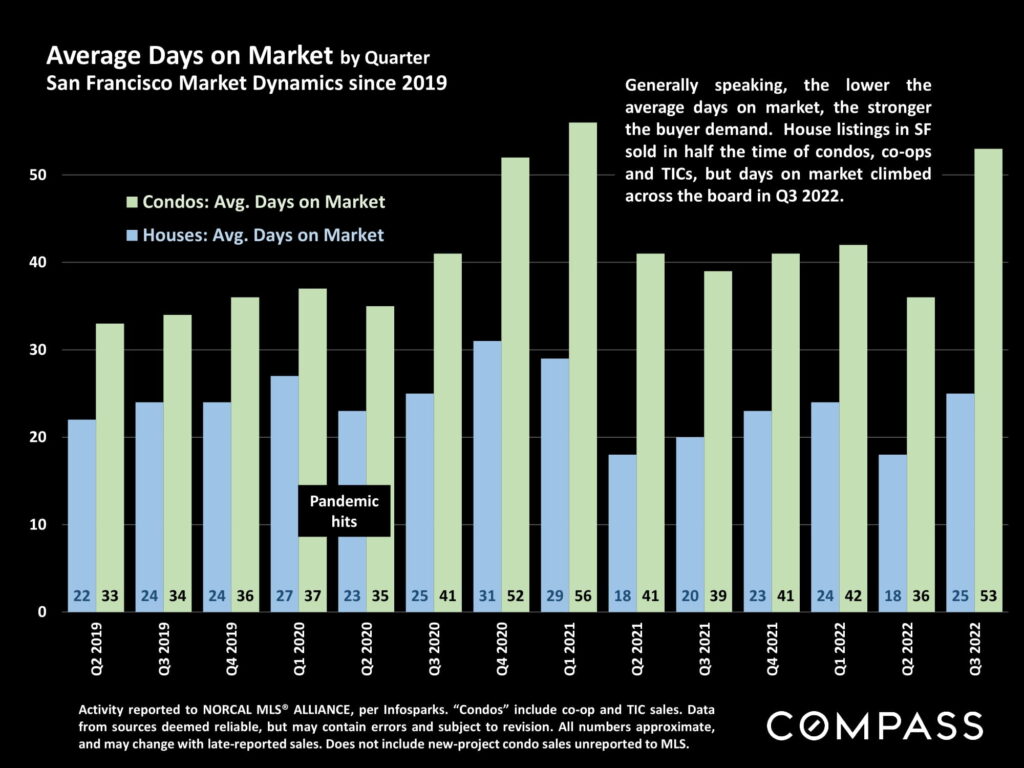

Generally speaking, sales numbers are no longer appreciably dropping, though overbidding statistics continue to

decline and days on market to climb.

When looking at recent market changes, it is important to remember how overheated the market was in 2021

and early 2022 – many quarter-to-quarter, and year-over-year comparisons are distorted by the unusual

(sometimes frenzied) conditions that prevailed then. It is also wise not to jump to definitive conclusions based

upon a single quarter’s data: The economy and real estate market are still in a period of adjustment.

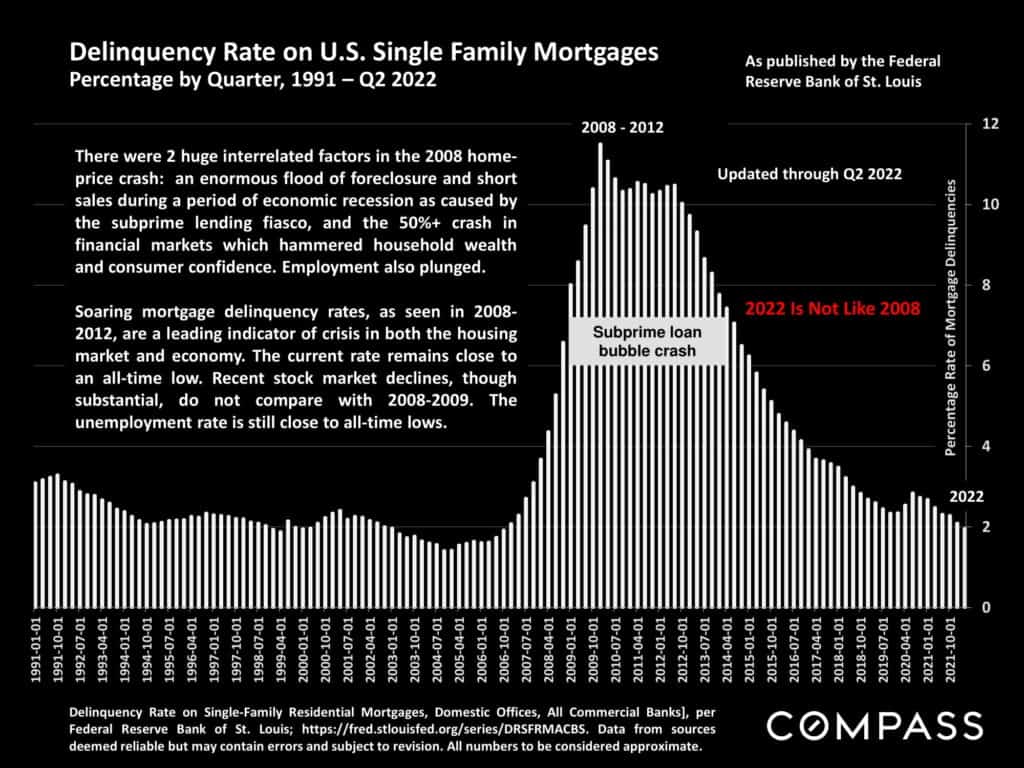

Comparisons with the crash of 2008 continue to be made, but the precipitating factor in the 2008 crash – tens of

millions of households talked into home loans they could never afford, forcing a tsunami of frantic sales

during the great recession – simply does not apply today. Mortgage payments as a percentage of income, and

loan delinquency rates are both close to all-time lows; most homeowners’ mortgages are held at historically low

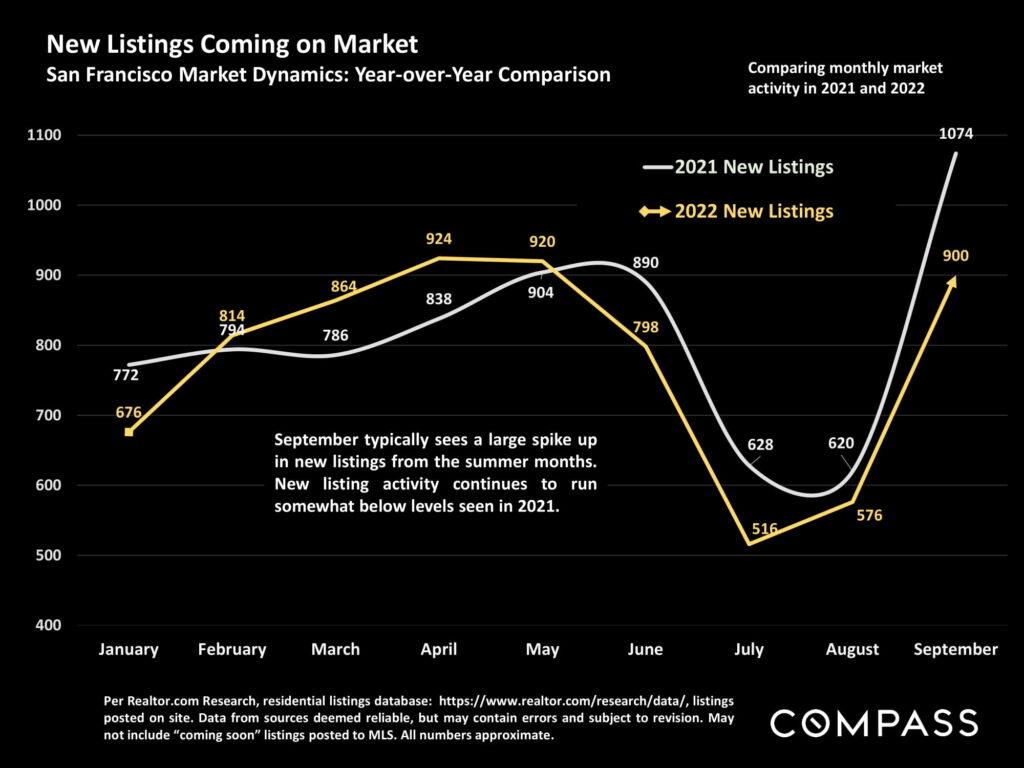

rates. There has been no surge of desperate sellers: New listing numbers are actually down from last year. Stock

market declines, though substantial, cannot compare with those seen in 2008-2009, and employment remains

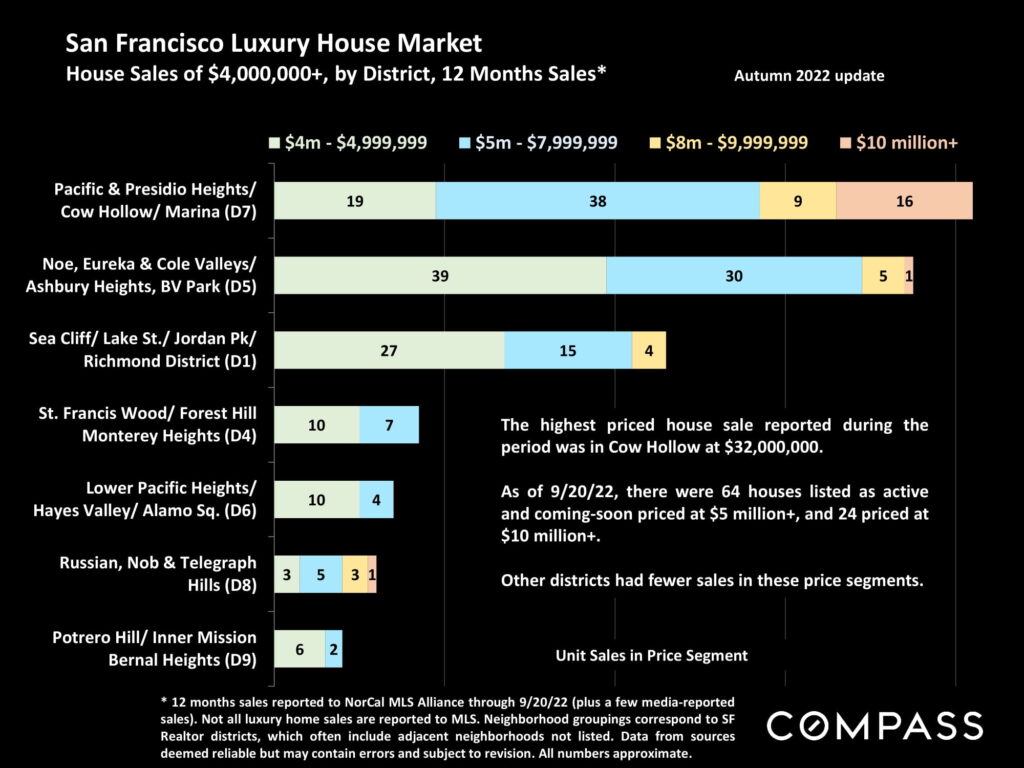

very strong. This is not to minimize the correction the market is going through: There are certainly major

economic and demographic challenges at play right now, but a market correction is not a crash, being more like a

slow leak in an over-pressurized tire than a blowout on the highway at high speed.

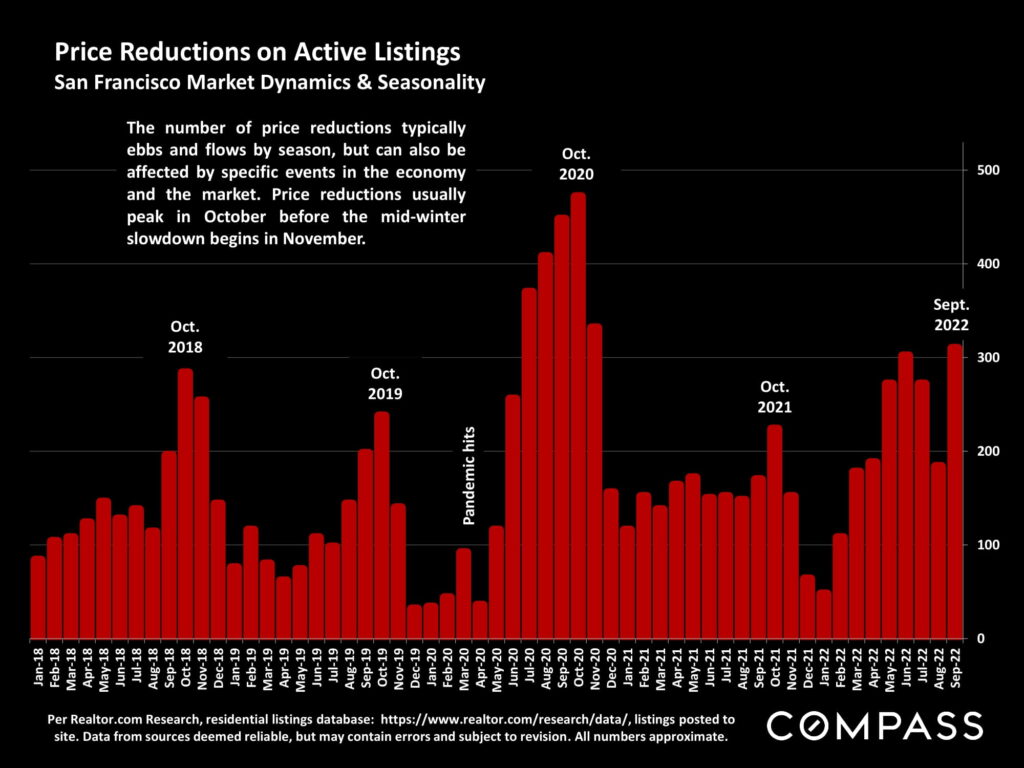

The relatively short autumn selling season began after Labor Day and runs through mid-November. The mid-

winter holiday slowdown then runs through mid-January. Though sales continue in every month of the year,

listing and sale activity drops dramatically as we near Thanksgiving. Slower markets can offer opportunities to

buyers, but the selection of homes for sale usually tumbles.

Statistics are generalities, essentially summaries of widely disparate data generated by dozens, hundreds or thousands of

unique, individual sales occurring within different time periods. They are best seen not as precise measurements, but as broad,

comparative indicators, with reasonable margins of error. Anomalous fluctuations in statistics are not uncommon, especially in

smaller, expensive market segments. Last period data should be considered estimates that may change with late-reported

data. Different analytics programs sometimes define statistics – such as “active listings,” “days on market,” and “months supply

of inventory” – differently: what is most meaningful are not specific calculations but the trends they illustrate. Most listing and

sales data derives from the local or regional multi-listing service (MLS) of the area specified in the analysis, but not all listings

or sales are reported to MLS and these won’t be reflected in the data. “Homes” signifies real-property, single-household

housing units: houses, condos, co-ops, townhouses, duets and TICs (but not mobile homes), as applicable to each market.

City/town names refer specifically to the named cities and towns, unless otherwise delineated. Multi-county metro areas will

be specified as such. Data from sources deemed reliable, but may contain errors and subject to revision. All numbers to be

considered approximate.

Many aspects of value cannot be adequately reflected in median and average statistics: curb appeal, age, condition, amenities,

views, lot size, quality of outdoor space, “bonus” rooms, additional parking, quality of location within the neighborhood, and

so on. How any of these statistics apply to any particular home is unknown without a specific comparative market analysis.

Median Sales Price is that price at which half the properties sold for more and half for less. It may be affected by seasonality,

“unusual” events, or changes in inventory and buying trends, as well as by changes in fair market value. The median sales price

for an area will often conceal an enormous variety of sales prices in the underlying individual sales.

Dollar per Square Foot is based upon the home’s interior living space and does not include garages, unfinished attics and

basements, rooms built without permit, patios, decks or yards (though all those can add value to a home). These figures are

usually derived from appraisals or tax records, but are sometimes unreliable (especially for older homes) or unreported

altogether. The calculation can only be made on those home sales that reported square footage.